Accelerating competition in the development of next-generation HUD display products with Micro-LED technology

This year, companies are engaged in intense competition to develop Micro-LED HUD products for automotive use at display exhibitions such as CES, Touch Taiwan, and SID. Major panel manufacturers such as AUO and Innolux in Taiwan, and BOE, TCL CSOT, and Tianma in China have unveiled a host of new products. These companies are the main suppliers of LCD HUD products.

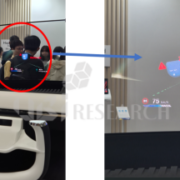

AUO exhibited a 13-inch micro LED AR HUD, while Innolux’s CarUX implemented a HUD on the windshield using a 9.6-inch Micro-LED reflective display solution with 9.6-inch Micro- LED.

AUO 13” AR HUD

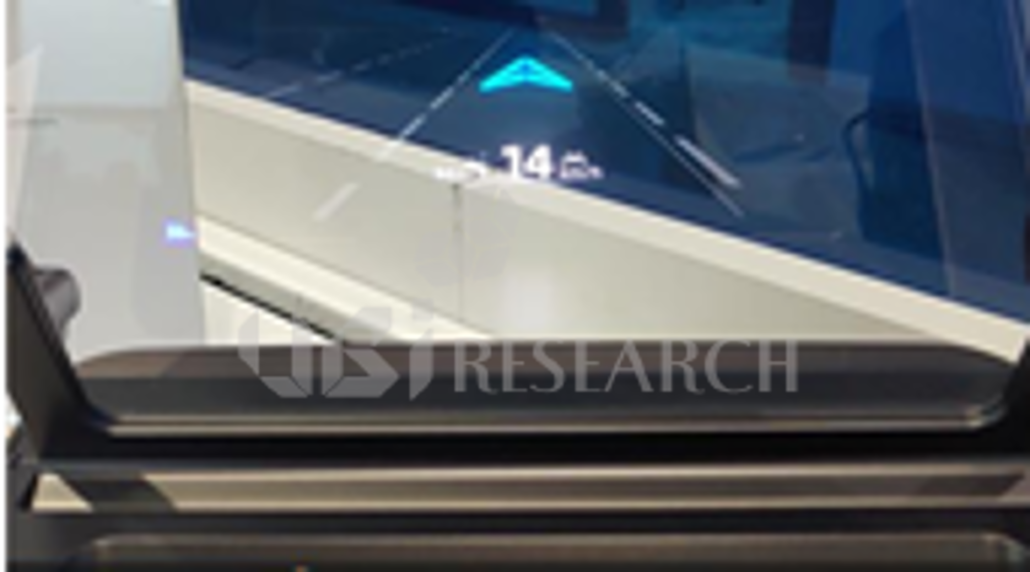

BOE showcased two HUD display solutions at SID. One is a 6.2-inch (624×360) RGB Micro-LED HUD, and the other is a monochrome Micro-LED HUD achieving up to 30,000 nits. TCL CSOT unveiled a 14.3-inch (1700 x 650) Micro-LED PHUD, while Tianma showcased an 8-inch (1204×608) HUD.

BOE 6.2” HUD

TCL 14.3” HUD

Tianma 8” HUD

These products achieve high resolution and high contrast ratios based on the advantages of Micro-LEDs, offering differentiation and the potential to replace existing LCOS products. As a result, panel manufacturers are engaging in intense competition to secure a technological lead in the market.

According to UBI Research’s “2025 Automotive Display Technology and Industry Trend Analysis Report,” this year’s vehicle display shipments are expected to exceed 240 million units, with Mini-LED and OLED panels gradually increasing. As competing technologies, companies are actively developing differentiated technologies applied to Micro-LED HUD products.

In summary, automotive displays are one of the key areas of the future display market. As the importance of displays has grown as a key differentiating factor in smart cars, the automotive display market will become an essential competitive arena for panel manufacturers. In other words, with the smart evolution of vehicles, HUDs will become mainstream, and companies will need to respond and compete accordingly.

Namdeog Kim, Senior Analyst at UBI Research(ndkim@ubiresearch.com)