Posts

LG Display showcased next-generation OLED under the theme of ‘Display technology that creates the future’ at ‘SID 2025’

/in Analyst column /by UBIResearchNetLG Display divided the SID 2025 exhibition hall into three zones to introduce the evolution of large OLED technology, vehicle display solutions targeting future mobility, and next-generation display technology for a sustainable future.

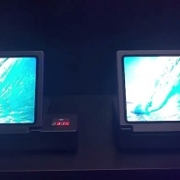

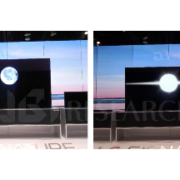

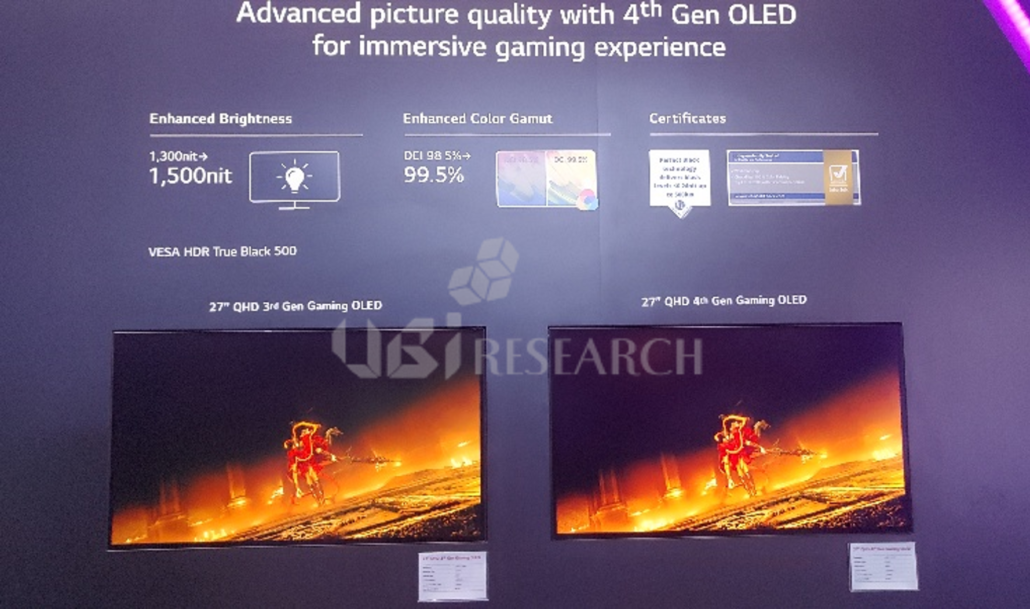

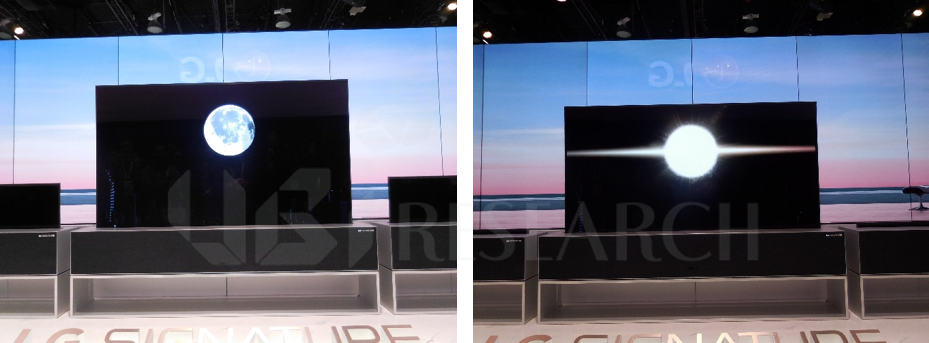

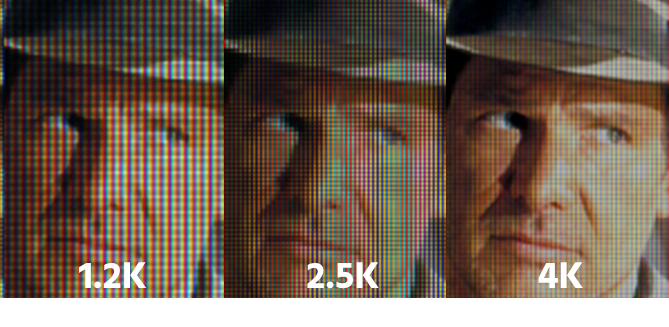

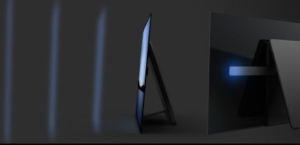

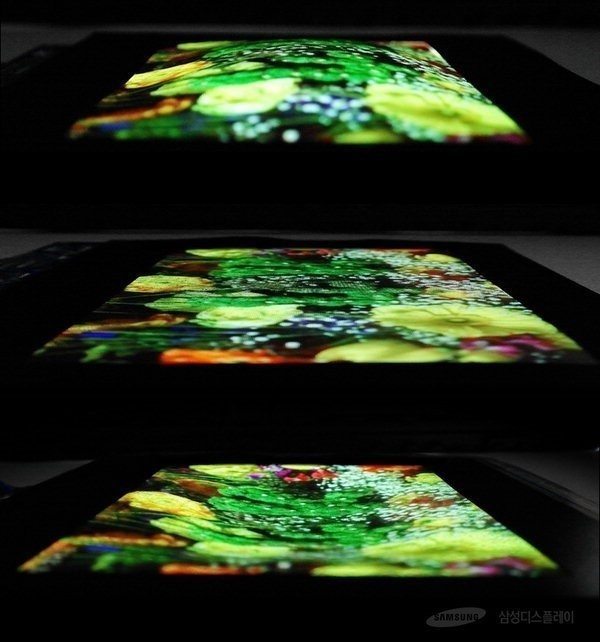

In the large OLED zone, the excellence of the 4th generation OLED panel and TV and gaming panels that applied it were showcased under the theme of ‘Another evolution for mainstream adoption.’ It achieved a maximum brightness of 4,000 nits by applying the ‘Primary RGB Tandem’ structure, a proprietary technology that independently stacks RGB devices to emit light. The ‘27-inch gaming OLED’ was exhibited to allow visitors to experience LG Display’s evolved gaming OLED, such as improved brightness and color reproducibility, by comparing products that applied the existing 3rd generation OLED with new products that applied the 4th generation OLED.

27-inch Gaming OLED: 3rd Gen vs 4th Gen OLED

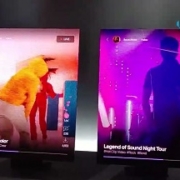

The ‘45-inch 5K2K gaming OLED’ that provides the best gaming experience with the world’s highest resolution (5120×2160) was also unveiled. Approximately 11 million pixels are densely arranged on the 45-inch large screen to realize excellent picture quality, and it features a 21:9 ratio similar to a movie theater screen to provide a next-level sense of immersion. LG Display’s proprietary technology ‘DFR (Dynamic Frequency & Resolution)’ that can optimize various contents from gaming to watching movies with a single monitor also garnered attention. Depending on the content, you can freely choose between high refresh rate mode and high resolution mode.

45-inch DFR gaming monitor

The ‘stretchable display for vehicles’ offers the possibility of innovation in future mobility design by applying a stretchable display whose screen can be freely stretched to the vehicle’s center fascia area where existing physical buttons were located.

A concept car that applied a vehicle display optimized for SDV was introduced. The front seat dashboard of the concept car was equipped with an ultra-large 57-inch pillar-to-pillar that LG Display commercialized for the first time in the industry, and an ‘18-inch sliderable OLED’ was installed for rear seat entertainment. It secured reliability and durability that can operate normally even in extreme environments from -40 degrees Celsius to 85 degrees Celsius, making it suitable for use in vehicles.

In addition, under the theme of ‘Display for a Sustainable Future,’ a next-generation display that applied low-power technology and eco-friendly components was unveiled. The ‘16-inch Neo:LED panel for laptops’ implemented the best color reproducibility suitable for professionals from photography to video production, while developing and applying new LED technology to reduce power consumption. This significantly improved the battery efficiency of IT devices. In addition, a ‘14-inch laptop panel’ was unveiled that made 41% of the product weight out of eco-friendly materials to preserve the future environment. LG Display plans to increase the use of eco-friendly materials in this product to 50% by 2030. In addition, it introduced tiling technology using micro -LED through a demonstration of operating two 22-inch micro-LED panels as independent screens and seamlessly connecting the two panels to operate them as a single screen.

Chang Wook HAN, VP/Analyst, UBI Research(cwhan@ubiresearch.com)

Summary of LG Display’s Hybrid Phosphorescent Blue Tandem Public Patent

/in Material, Material, Material, Material, Material, Material, Material /by UBIResearchNetIf we look at the contents of the recently published hybrid phosphorescent blue tandem patent, it is evaluated as a patent that can apply phosphorescent blue to product production at an early stage. This is because it uses a luminescent material that has been verified and can be mass-produced by a material company, and the current OLED deposition system optimized for mixed host can be used as is.

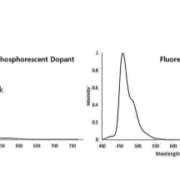

The main contents of the patent are that

– The phosphorescent emitting layer must be configured at the top, and in this case, the efficiency index (blue index) increases by 1.7 times compared to the fluorescent blue tandem. (If the phosphorescent emitting layer is located at the bottom, the efficiency index increases by only 1.4 times.)

– The thickness of the fluorescent emitting layer must be 60% or less of the phosphorescent emitting layer thickness.

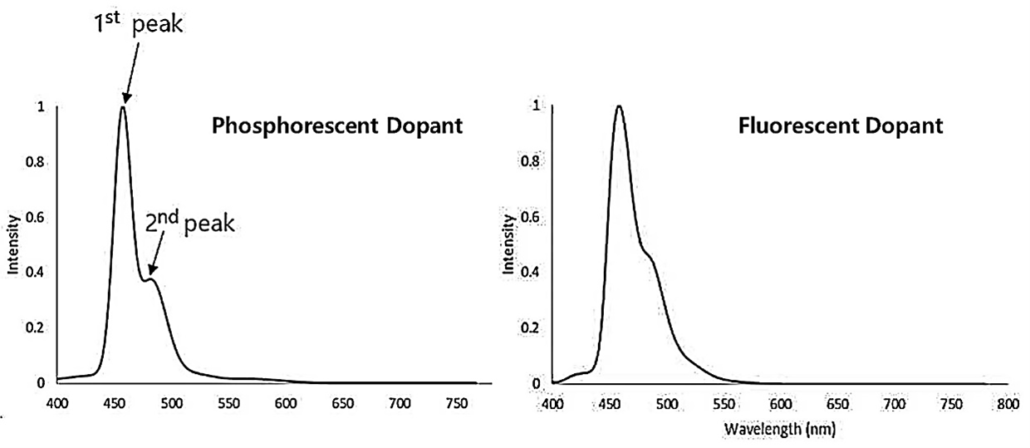

– As shown in the figure below, the blue phosphorescent dopant spectrum must have a second peak intensity of 50% or less of the first peak intensity.

– The difference between the highest intensity wavelength of the phosphorescent dopant and the highest intensity wavelength of the fluorescent dopant must be 20 nm or less.

We look forward to seeing LG Display’s blue phosphorescent panel, which has completed product verification, at Display Week 2025.

Chang Wook HAN, VP/Analyst, UBI Research(cwhan@ubiresearch.com)

Preview of SID 2025

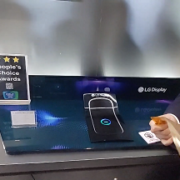

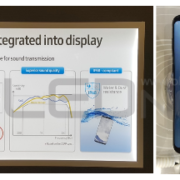

/in /by UBIResearchNetSamsung Display’s ‘LEAD™’, the world’s first non-polarized OLED technology commercialized, has won the ‘Displays of the Year (DIA)’ award from the Society for Information Display (SID). ‘LEAD™’ is an OCF (On Cell Film) technology that replaces the polarizer, an opaque plastic sheet, and has been praised for improving brightness, enhancing outdoor visibility, and making the panel 20% thinner.

Samsung Display is actively marketing its proprietary technology to the market through the brand name ‘LEAD™’, which includes the four representative characteristics of this technology: ▲Low Power Consumption ▲Eco-Friendly ▲Augmented Brightness ▲Designed to Slim & Light.

SDC LEAD™ Technology

LG Display plans to showcase the world’s best vehicle display optimized for future mobility under the theme of ‘Expanding business through new technology (Driving the future)’.

With ▲Vehicle stretchable display solution that can display all spaces in a vehicle, it proposes design innovation possibilities suitable for future mobility. The stretchable display, which implements high-resolution 100ppi (pixels per inch) and red, green, and blue (RGB) full colors at the same time as a general monitor while the screen can be stretched by up to 50%, has been applied to the center fascia area of the vehicle to maximize aesthetics and convenience.

LG Display, which recently succeeded in commercializing the world’s first ’40-inch pillar-to-pillar’, is exhibiting ▲57-inch vehicle pillar-to-pillar, the world’s largest single panel. ▲18-inch sliderable OLED unfolds from the ceiling down only when needed. It implements entertainment functions with OLED’s unique three-dimensional picture quality and provides a new mobility experience. In the trend of larger vehicle displays, we introduce ▲SPM (Switchable Privacy Mode) mode, a key technology that enhances safety by controlling viewing angles.

LG Display Automotive Stretchable Micro-LED Display

Chang Wook HAN, VP/Analyst, UBI Research(cwhan@ubiresearch.com)

LG Display Hybrid Phosphorescent Blue Tandem Product Verification and Patent Application

/in /by olednetLG Display announced on May 1 that it had successfully verified the performance of a blue phosphorescent OLED panel for mass production for the first time in the world. Following the development of blue phosphorescence in collaboration with UDC last year, this achievement was made in just 8 months, and it is evaluated as one step closer to realizing the ‘dream OLED’.

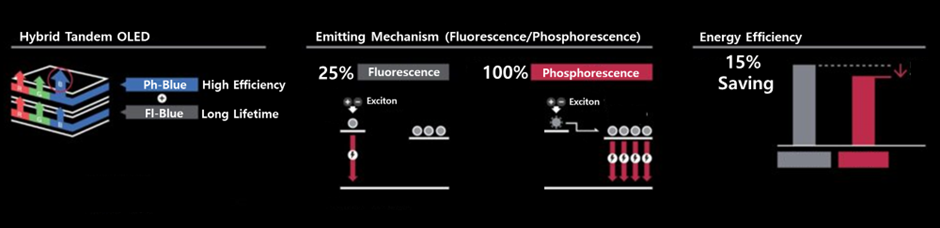

LG Display solved this problem with a hybrid two-stack tandem structure that stacks blue fluorescent material on the lower layer and blue phosphorescence on the upper layer. By adding the stability of the fluorescent method and the low power of the phosphorescent method, it maintained the stability of the existing OLED panel while reducing power consumption by about 15%.

In particular, LG Display is the first company to have successfully completed the productization stage, which requires performance evaluation, optical characteristics, and fairness on an actual mass production line, and has already completed product verification with UDC.

(Source: LG Display)

LG Display has exclusively applied for a hybrid phosphorescent blue tandem technology patent in both Korea and the United States. According to LG Display’s published patent, the hybrid phosphorescent blue tandem is shown to achieve efficiency that is about 1.7 times higher than the existing fluorescent blue tandem. In order to optimize efficiency, color coordinates, and lifespan, the spectral shape of the blue phosphorescent dopant, the thickness ratio of the fluorescent layer and the phosphorescent layer, and the location of the emitting layer are important, and the patent rights the technology content centered on these factors. It is evaluated as a patent that optimizes the commercialization of the hybrid phosphorescent blue tandem by utilizing high-efficiency phosphorescence and long-life fluorescence.

LG Display’s OLED panel with hybrid two-stack tandem applied can be seen at the world’s largest display event, ‘SID (Society for Information Display) 2025’, held in San Jose, California, USA from the 11th of this month (local time). The products on display this time are small and medium-sized panels that can be applied to IT devices such as smartphones and tablets. As the number of products that require both high image quality and high efficiency, such as AI PCs and AR/VR devices, is increasing, the application of blue phosphorescence technology is expected to expand rapidly.

Yoon Soo-young, CTO (Executive Vice President) of LG Display, said, “The success of the verification of blue phosphorescence productization, which is called the last puzzle for the dream OLED, will be an innovative milestone toward next-generation OLED,” and “We expect to be able to enjoy the effect of preempting the future market with blue phosphorescence technology.”

Chang Wook HAN, VP/Analyst, UBI Research(cwhan@ubiresearch.com)

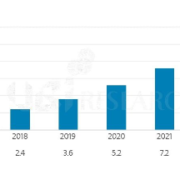

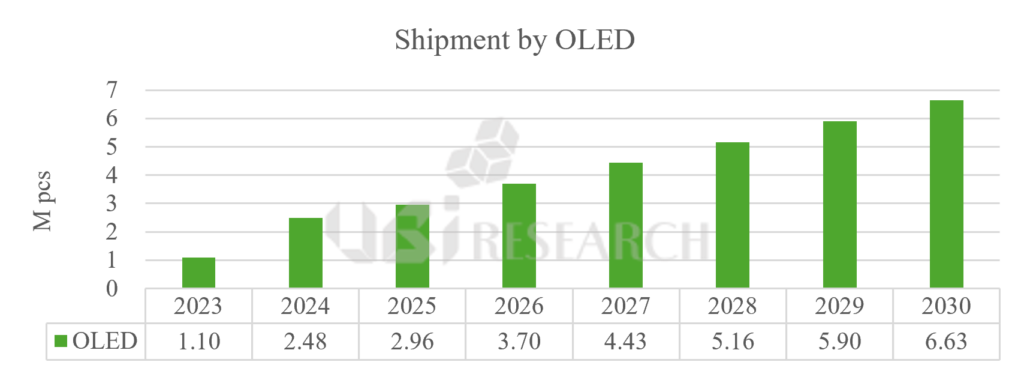

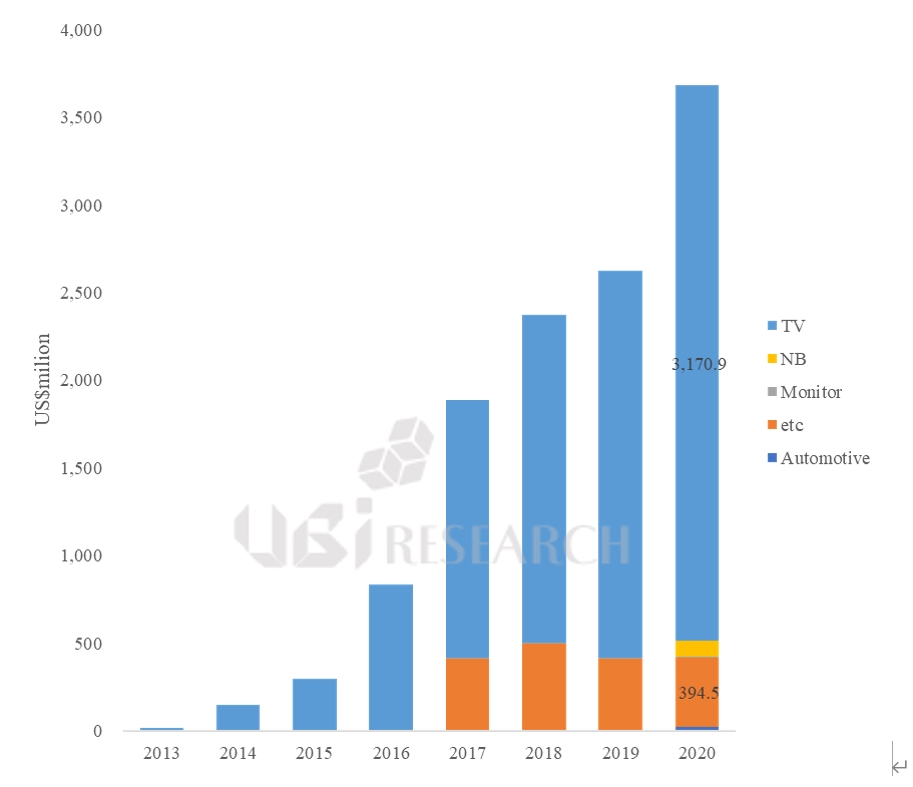

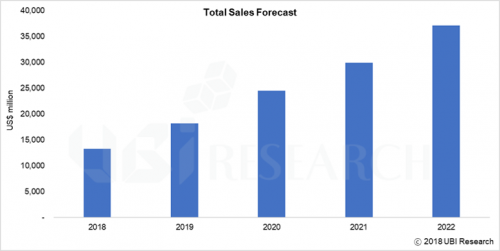

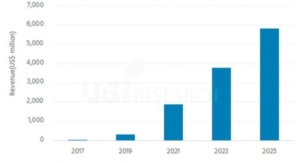

OLED Automotive Display Shipments to Hit 2.48 Million Units in 2024: Up 126% YoY

/in Focus on /by olednetIn the ‘2025 Automotive Display Technology and Industry Trends Analysis Report’ by UBI Research, various technologies, companies, and market trends of automotive displays were introduced. In 2024, global shipments of automotive display panels reached 236 million units, an 8.3% increase from the previous year. It is expected to reach 241.8 million units in 2025. In 2024, OLED panel shipments reached approximately 2.48 million units, an increase of 126% from the previous year.

This is because OLED displays can contribute to the sophistication and efficiency of vehicle interior design, so OLEDs are actively adopted, especially in premium cars. Hyundai Motor Company’s Genesis GV80 vehicle, released last year, applied a 27-inch OLED display produced by LG Display. In addition, Nio, a Chinese EV car manufacturer, will adopt a 15.6-inch OLED and a 14.5-inch OLED display for passengers in its 2025 ET9 model.

27-inch OLED mounted on Genesis GV80 (source: Hyundai Motor Company)

As the entertainment use of vehicle displays increases, LCD displays are increasingly adopting Mini-LED with local dimming to provide a contrast ratio similar to OLED. In 2024, Mini-LED panel shipments was more than double to 3.4 million units compared to the previous year. Sony Honda Mobility’s electric vehicle, AFEELA, to be released in 2026, will use a 40-inch Pillar-to-Pillar Mini-LED display provided by LG Display.

“Software-defined vehicles (SDVs) require high resolution, low power, AR, and multi-display performance, and they require real-time data provision and optimized user experience. Accordingly, the adoption of OLED displays suitable for this will continue to expand, and vehicle OLED panel shipments will reach approximately 3 million units in 2025,” said Chang Wook Han, Executive Vice President of UBI Research.

Chang Wook HAN, VP/Analyst, UBI Research(cwhan@ubiresearch.com)

Apple iPhone 18 series, release schedule adjusted by specifications

/in /by olednet

Apple iPhone 16 (Source: Apple)

It is anticipated that Apple will delay the launch of the standard model in the iPhone 18 series, which is expected to be released in 2026.

Until now, Apple has released four models for each iPhone series: the standard model, Max, Pro, and Pro Max. In the 2025 iPhone 17 series, the Max model is expected to be replaced by a new Air model, and the Air model is projected to be the most expensive among the four.

While four smartphone models are expected to be released through 2025, it is now anticipated that the standard model will not be launched in 2026 and will be postponed to 2027.

In 2026, when Apple is expected to release the iPhone 18 series, the company is also likely to introduce its first foldable phone. Since the launch of the foldable phone could disperse sales volume, this strategic move seems to be under consideration.

If the release of the iPhone 18 standard model is delayed to the first half of 2027, it is expected to launch alongside the successor to the iPhone 16e, which is also anticipated to debut around that time. In this scenario, Apple would release higher-end models—such as the Pro, Air, and foldable phone—in the second half of the year, and lower-priced models in the first half of the following year, thereby securing different sales routes throughout the year.

Should Apple adopt this biannual product release strategy, it may affect the performance of panel suppliers such as Samsung Display, LG Display, and BOE. Historically, the release of the iPhone series in Q3 boosted the earnings of Korean panel makers starting in the third quarter, peaking in Q4. However, if new iPhone models are also released in the first half going forward, the earnings gap between the first and second halves of the year may narrow. On the other hand, if BOE continues to fall short in technology and only supplies panels for the standard model, its strong performance in the second half may shift to the first half instead.

Junho Kim, UBI Research analyst(alertriot@ubiresearch.com)

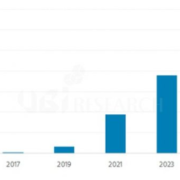

OLED material usage in 2024 will reach a record 130 tons, surpassing 200 tons in 2028

/in /by olednet

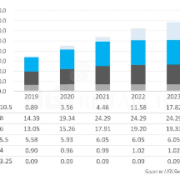

1Q25 Quarterly OLED Emitting Material Market Tracker

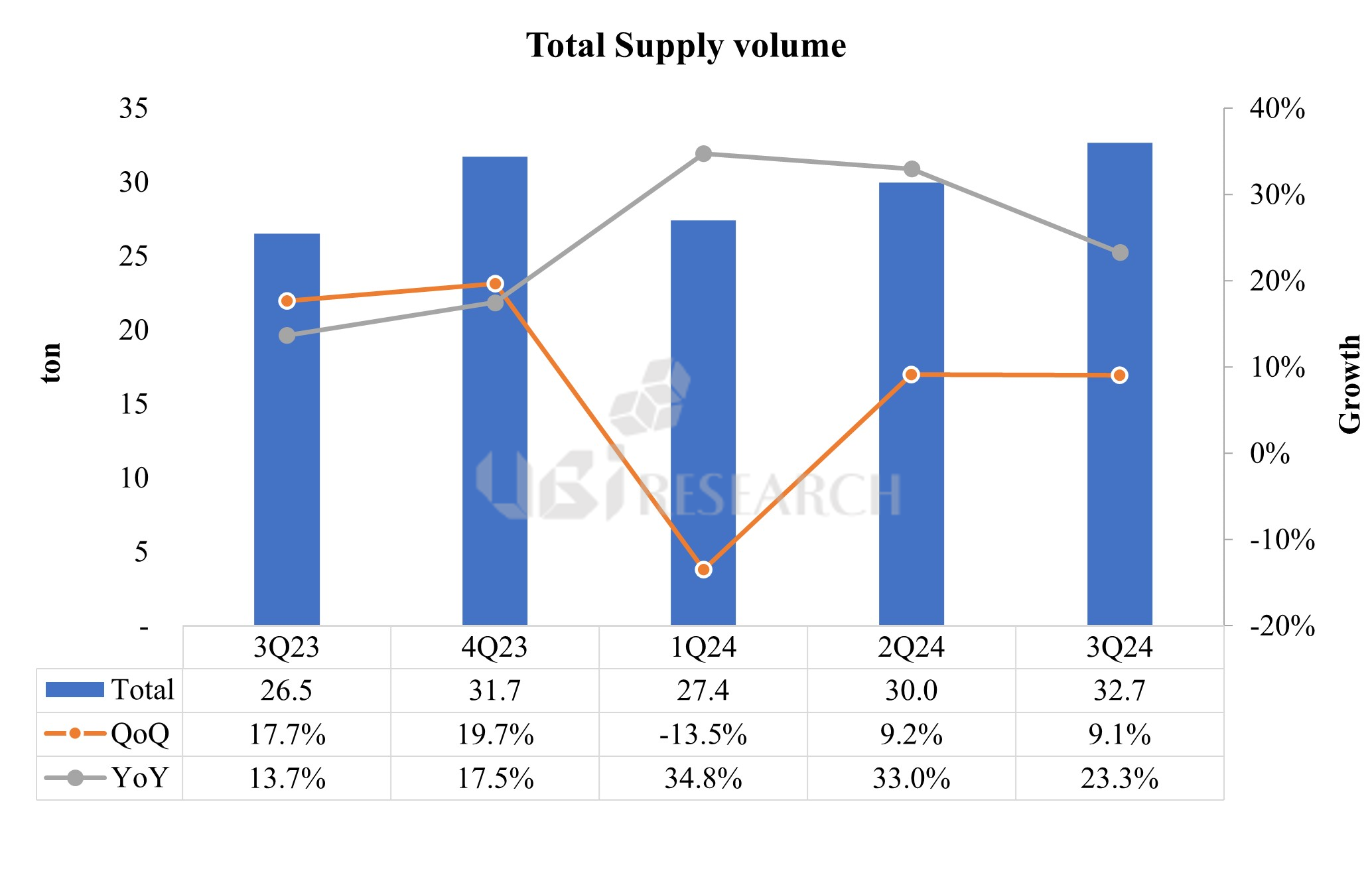

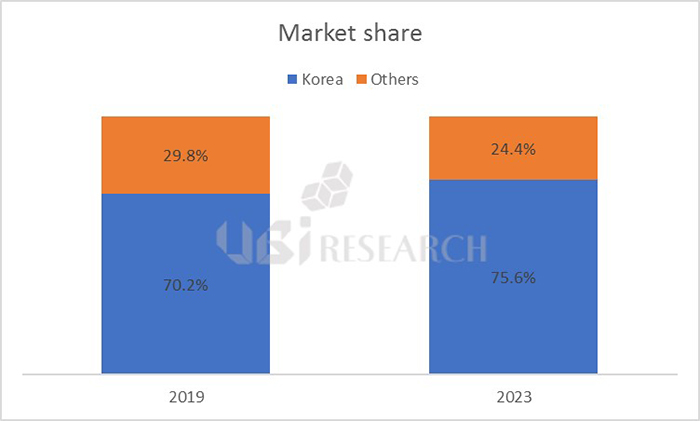

According to UBI Research’s “1Q25 Quarterly OLED Material Market Tracker,” the amount of emitting material used in 2024 was 130 tons. Shipments from Korean and Chinese panel makers increased simultaneously, up nearly 30% from 2023.

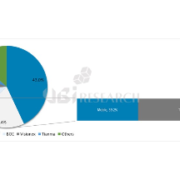

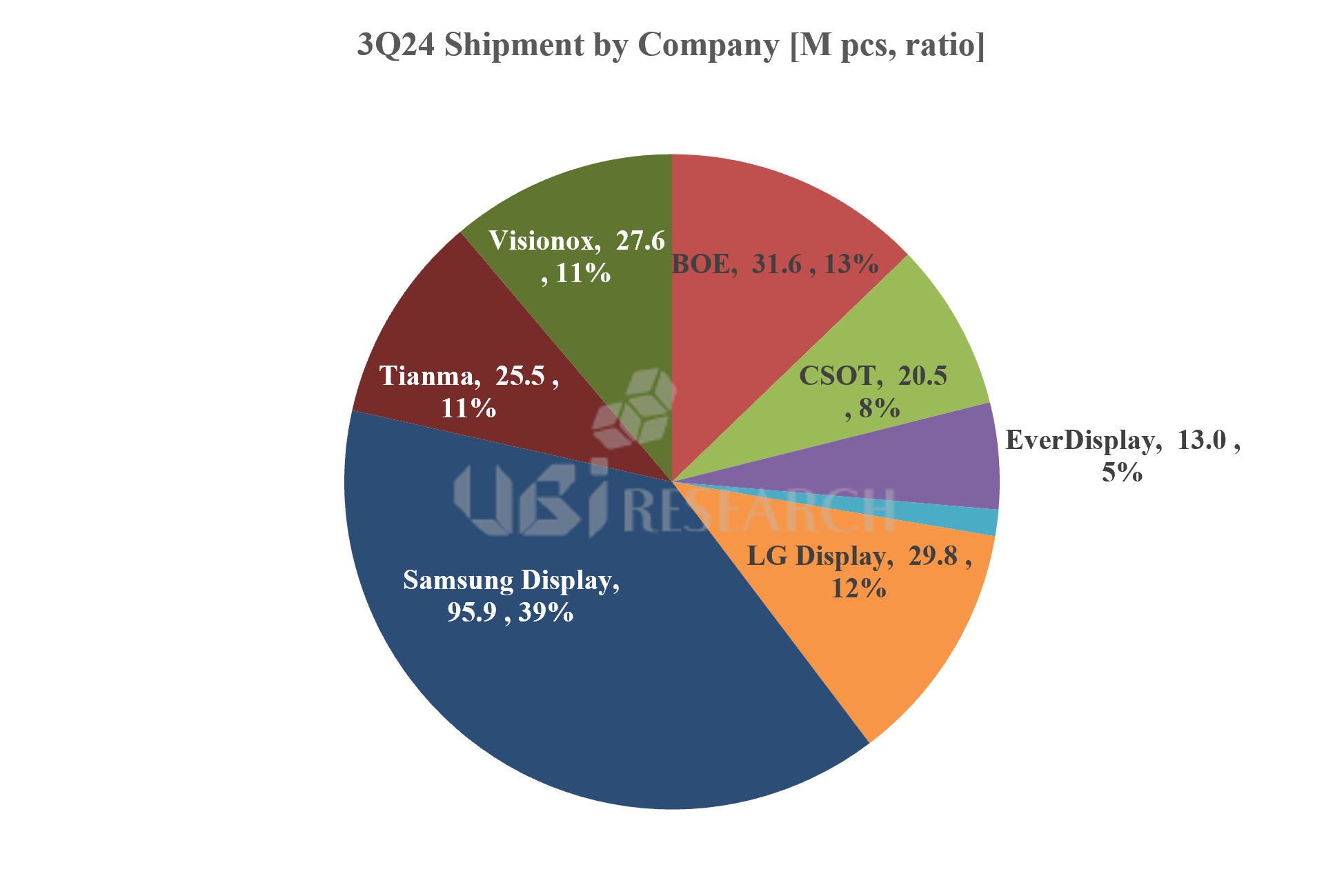

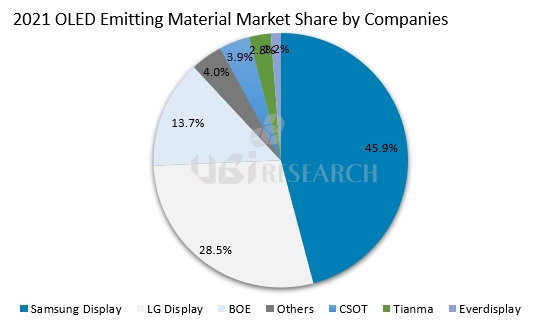

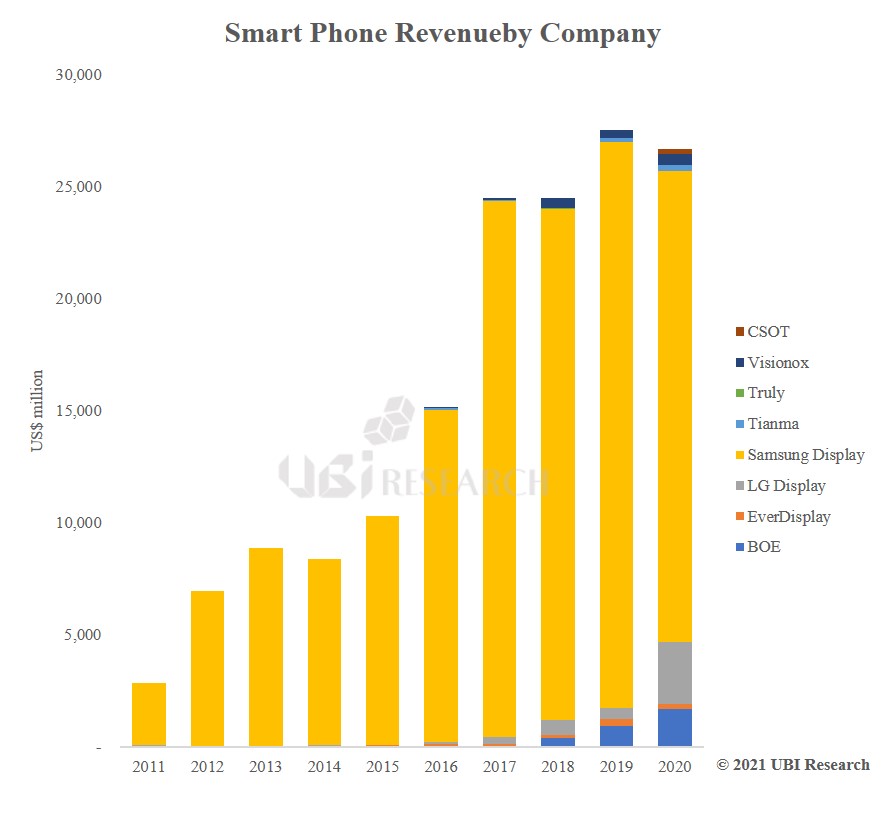

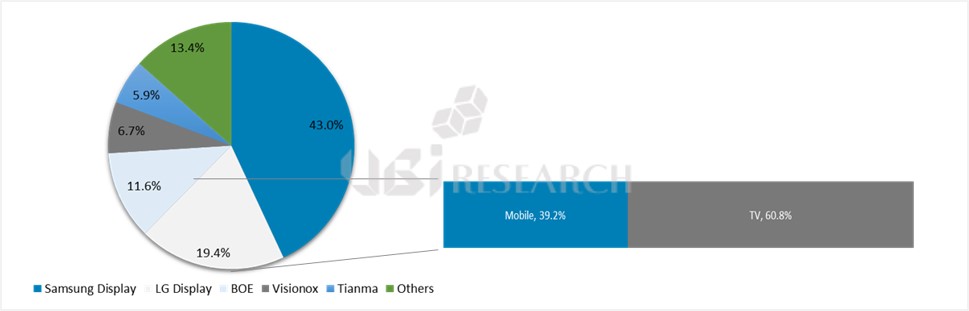

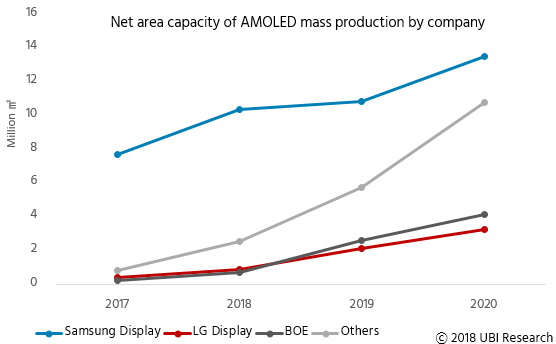

By company, Samsung Display continues to hold the largest share, and its rigid OLED shipments have been rising rapidly, driving material usage higher and higher. Samsung Display accounted for 42% of the total OLED emission materials market by volume, followed by LG Display at 20% and BOE at 13.2%.

While Korean panel makers still dominate in terms of material usage, Chinese panel makers are not far behind. In China, OLED shipments for smartphones from BOE, TCL CSOT, Tianma, Visionox, and EDO grew at a CAGR of 51% from 114 million units in 2021 to 394 million units in 2024. In addition, as Chinese panel makers such as BOE and EDO have recently begun supplying OLED panels for IT, the consumption of luminescent materials by Chinese panel makers is expected to increase even more steeply.

“In 2025, Samsung Display and LG Display are expected to ship more panels for iPhones than in 2024, and the overall shipments of IT devices such as tablet PCs, notebooks, and monitors are expected to increase significantly compared to 2024, so the growth of the luminescent material market is expected to continue for a while,” said Dr. Changho Noh of Ubi Research. “Additionally, with the expansion of mass production of OLEDs for IT by Chinese panel companies, the luminescent material market is expected to exceed 200 tons by 2028.”

Chang Ho NOH, UBI Research Analyst(chnoh@ubiresearch.com)

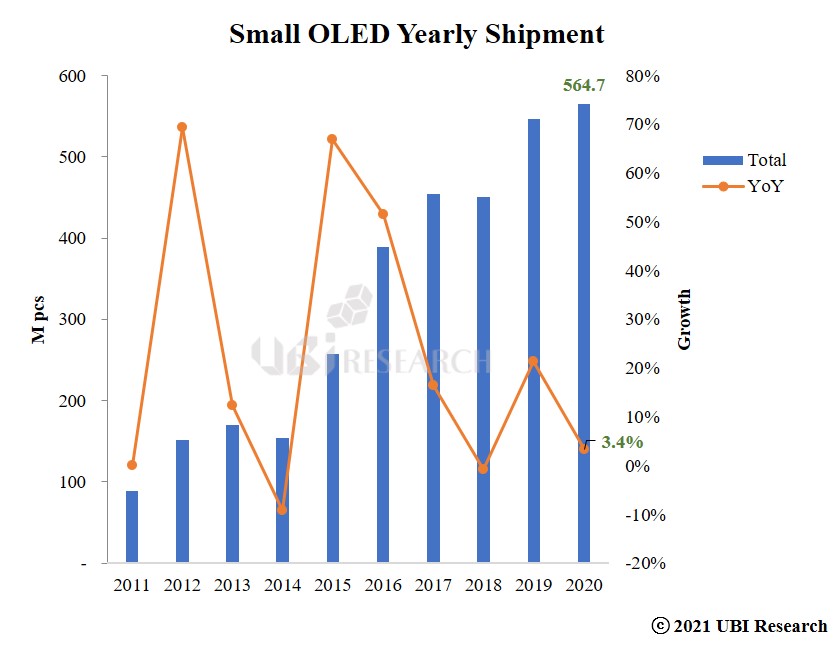

Small OLED display shipments in 2024 are expected to increase by 200 million units compared to 2023 and exceed 1 billion units in 2025

/in /by olednet

‘1Q25 Small OLED Display Market Track’

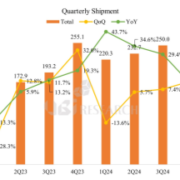

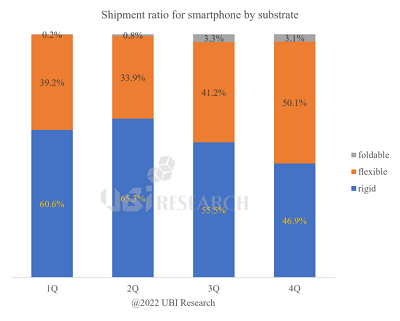

According to UBI Research’s ‘1Q25 Small OLED Display Market Track’, which includes application performance and outlook for smartphones, foldable phones, smartwatches, etc., small OLED shipments in 2024 are expected to reach 980 million units, an increase of approximately 200 million units from 773 million units in 2023. The small OLED market is expected to exceed 1 billion units in 2025.

Looking at the 2024 performance, most panel manufacturers in Korea and China saw an increase in shipments of 40 to 50 million units, and in particular, Chinese panel manufacturers TCL CSOT, Tianma, Visionox, and Everdisplay saw shipments increase by more than 50% compared to 2023. BOE, China’s largest panel manufacturer, saw its panel shipments increase by only about 8% due to temporary production suspensions caused by disruptions in iPhone supplies throughout the year.

Not only Chinese panel makers, but also Korean panel makers have seen a significant increase in shipments. As rigid OLED panels began to be applied to Samsung Electronics’ Galaxy A series, Samsung Display’s shipments are expected to surge from 320 million units in 2023 to 380 million units in 2024. LG Display’s smartphone OLED shipments also increased from 52 million units in 2023 to 68 million units in 2024 as its supply of panels for iPhones expanded.

With Chinese panel makers’ shipments steadily increasing, and Samsung Display’s rigid OLED shipments and LG Display’s iPhone panel shipments also increasing, small OLED shipments in 2025 are expected to easily exceed 1 billion units.

“OLEDs are being widely applied to lower-end models of Samsung Electronics’ Galaxy A series and low-cost models from Chinese set manufacturers, and BOE and Visionox’s new 8.6G lines are also designed to produce panels for smartphones, so small-sized OLED shipments are expected to continue to rise for the time being,” said Han Chang-wook, Vice President of UBI Research.

Chang Wook HAN, VP/Analyst, UBI Research(cwhan@ubiresearch.com)

Moving forward with ultra-large vehicle displays

/in Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on, Focus on /by olednetNot only are vehicle displays increasing in size and number, but pillar-to-pillar displays, which integrate multiple displays on the dashboard into a single screen, have recently been applied to automobiles. Pillar-to-pillar displays have the advantage of enhancing the competitiveness of premium automobile brands through simple and stylish interiors, and allowing users to enjoy movies and games in the car through large screens. The Geely Galaxy E8 EV, launched last year, is equipped with a 45-inch pillar-to-pillar display. The display is a panel with amorphous silicon TFTs and Mini-LEDs and was supplied by BOE.

Sony Honda Mobility’s upcoming 2026 electric vehicle, AFEELA, will feature a 40-inch pillar-to-pillar display. The 40-inch pillar-to-pillar display panel with LTPS TFT and Mini-LEDs is provided by LG Display.

(Source: LG Display)

TPS TFTs have the advantage of faster mobility than amorphous silicon TFTs, making it easier to create high-resolution, high-brightness panels and reducing the black border, known as the bezel. And Mini-LEDs that utilize localized dimming are more expensive as the number of chips increases, but they offer OLED-like image quality with higher contrast and reduced thickness, which is important for external viewability.

“The share of LTPS TFTs in automotive displays was 34.7% in 2024 by revenue and will grow to 52.3% by 2030,” said Chang Wook Han, principal analyst at UBI Research. “The share of Mini-LEDs in automotive displays was 6.4% in 2024 and will increase to 29.1% by 2030,” said Han.

Chang Wook HAN, UBI Research Analyst(cwhan@ubiresearch.com)

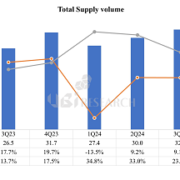

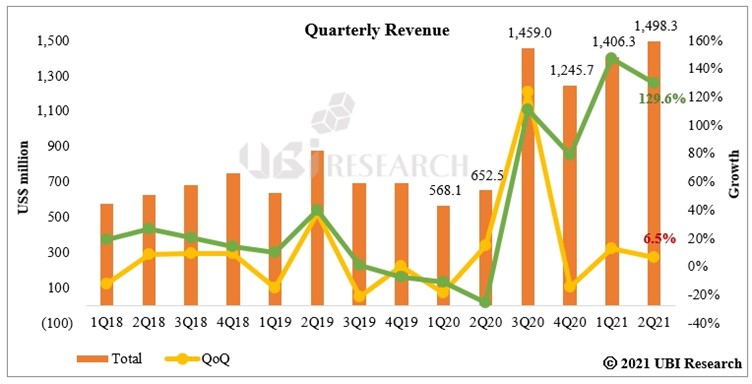

The purchase volume of OLED emitting materials in the third quarter of 2024 is expected to reach 32.7 tons, the highest ever purchase volume of emitting materials in 2024

/in /by olednet

According to UBI Research’s ‘4Q24_Quarterly OLED Emitting Material Market Tracker’, the purchase volume of emitting materials in the third quarter of 2024 was calculated to be 32.7 tons. Previously, material purchases were highest in 2021, when the market expanded due to COVID-19, but the all-time high was renewed in the third quarter of 2024. Considering the characteristics of OLED emitting materials, which show the highest usage in the fourth quarter of every year, it is expected that 2024 will see the highest usage ever.

Looking at each company, Samsung Display consistently holds the highest market share. Samsung Display had a 41.4% share in the entire OLED emitting material market based on purchase volume, followed by LG Display with 20.5%, BOE with 11.6%, and Visionox with 8.3%.

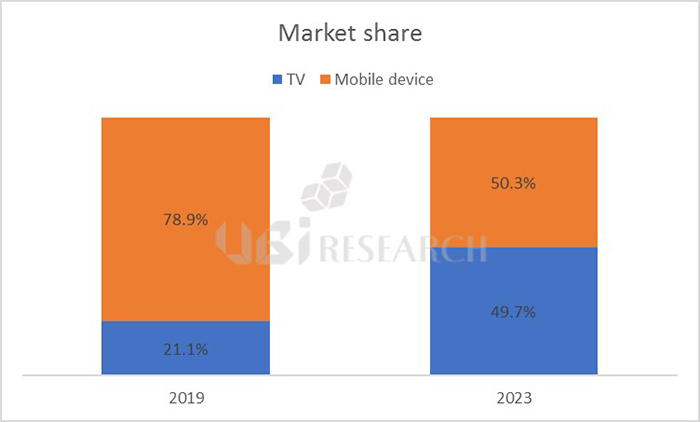

By substrate, RGB OLED still maintains the 80% level with a market share of 83.7% based on purchase volume, and as 8.6G lines begin to operate in earnest, RGB OLED’s market share is expected to gradually decline. WRGB-OLED’s market share was 11.3%, similar to the second quarter, and QD-OLED’s market share was 2.8%.

The market share of RGB 2 stack tandem OLED once rose to 6.4% in the second quarter due to a surge in iPad Pro OLED shipments but fell to the 2.2% range in the third quarter due to low demand. Compared to panel shipments, IT devices that use 2-stack tandem OLED for smartphone OLED, which uses single stack OLED, have large panel areas and have two light-emitting layers, so material purchase volume accounted for a higher share than shipment volume.

However, as BOE’s 8.6G line was confirmed to supply OLED for smartphones first, the growth of the 2 stack tandem OLED market was in the hands of Samsung Display. Starting in 2026, when OLED is expected to be applied to MacBook Pro, the purchase amount of light emitting materials applied to 2 stack tandem OLED is expected to more than double compared to 2024. The 2-stack tandem OLED panel supplied to MacBook Pro is expected to be supplied first by Samsung Display.

Junho Kim, UBI Research analyst(alertriot@ubiresearch.com)

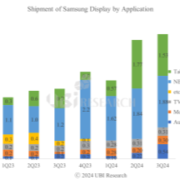

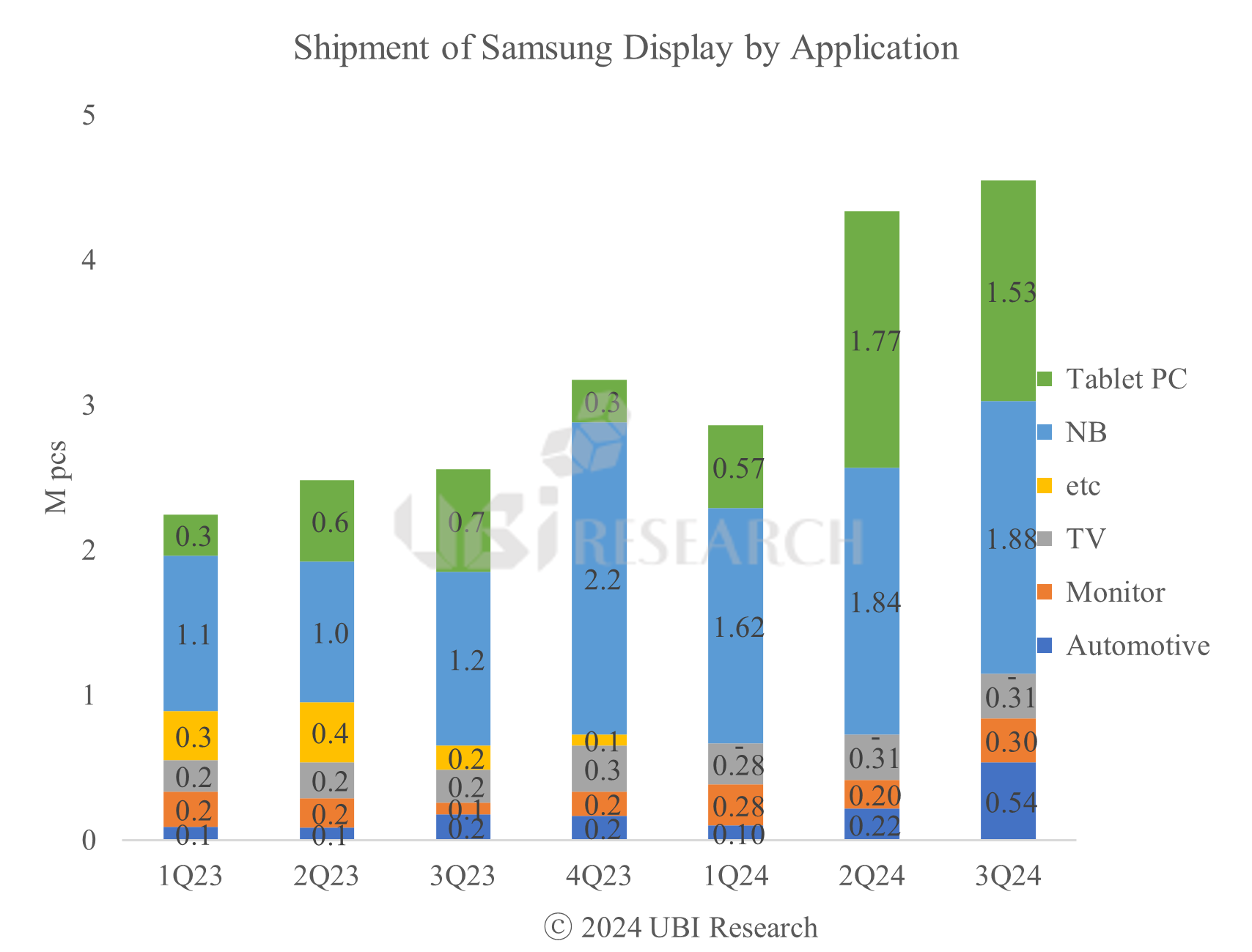

Samsung Display’s Auto OLED shipments surge, sales remain strong even as tablet PC panel shipments decrease

/in /by olednet

UBI Research ‘4Q24 Medium & Large OLED Display Market Track’

Samsung Display’s mid- to large-sized OLED shipments and sales in the third quarter were similar to those in the second quarter. Due to low sales of iPad Pro OLED, OLED shipments for tablet PCs decreased, but shipments increased in other applications and sales remained at a similar level. Samsung Display supplies mid- to large-sized OLED products for a variety of applications, including not only tablet PCs but also notebooks, monitors, and automotive OLEDs.

According to UBI Research’s recently published ‘4Q24 Medium & Large OLED Display Market Track’, as iPad Pro OLED panels began to be mass-produced in earnest in the second quarter, the shipments and sales of mid-to-large-size OLED panels from Samsung Display and LG Display surged. However, in the third quarter, panel shipments plummeted due to low sales of iPad Pro OLED, leading to a sharp decline in tablet PC OLED shipments and sales for both panel companies.

OLED shipments for TVs and OLEDs for tablet PCs increased rapidly at the same time, and LG Display’s shipments, which achieved its highest quarterly performance since the fourth quarter of 2021, decreased by 34% compared to the previous quarter, and sales decreased by 23%. However, because OLED shipments for TV recovered compared to the previous year, mid- to large-sized OLED shipments increased by 124% and sales increased by 111% compared to the same period last year.

In the case of Samsung Display, tablet PC shipments and sales also decreased. Samsung Display supplies OLED for tablet PCs to Samsung Electronics and Apple. Although OLED shipments for tablet PCs to Samsung Electronics did not change significantly, panel supply to Apple decreased. Accordingly, sales for tablet PCs also decreased by 38% compared to the previous quarter, but sales were able to be maintained similar to the previous quarter due to increased sales of other applications. Among Samsung Display’s applications, the one that has grown the most is automotive OLED. Automotive OLED shipments are rapidly increasing to 100,000 units in the first quarter, approximately 200,000 units in the second quarter, and approximately 500,000 units in the third quarter.

Samsung Display’s mid- to large-sized OLED shipments, which are investing in 8.6G, are expected to increase further from the end of 2025. As Samsung Display advances the mass production of its 8.6G line to the end of 2025, market expansion is expected to accelerate further. The notebook and monitor markets, as well as tablet PC and auto OLED, are expected to grow rapidly upon Apple’s entry into the market.

Junho Kim, UBI Research analyst(alertriot@ubiresearch.com)

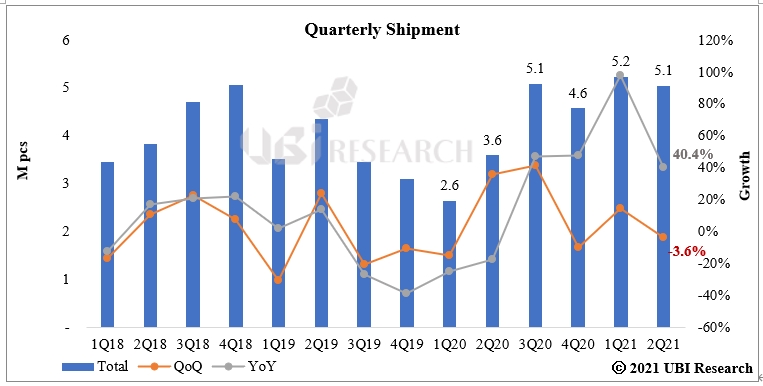

Small OLED shipments in the third quarter increased by 7.8% compared to the previous quarter, and LG Display’s shipments surged

/in /by olednet

‘4Q24 Small OLED Display Market Track’

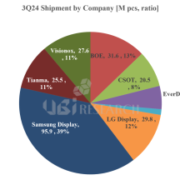

The small OLED market in the third quarter rose 7.8% compared to the previous quarter. Most panel companies recorded panel shipments at a similar level to the second quarter, but overall shipments increased as shipments from LG Display and China’s Everdisplay surged.

According to the ‘4Q24 Small OLED Display Market Track’ recently published by UBI Research, small OLED shipments in the third quarter of 2024 were 247 million units, up 7.8% compared to the previous quarter and 32.6% compared to the same quarter of the previous year. The shipments of Chinese panel companies, including Samsung Display and BOE, were similar to or slightly lower than the previous quarter, but as the shipments of LG Display and China’s Everdisplay surged, overall shipments increased.

Based on the iPhone 16 series, which began full-scale production, LG Display shipped 17.6 million iPhone panels, a 64% increase from the previous quarter, and smartwatch shipments increased 147% to 12.2 million units. Due to the impact of increased shipments, LG Display’s sales increased by 74% compared to the previous quarter and by 115% compared to the same quarter of the previous year.

LG Display’s shipments are expected to continue to increase next year following the fourth quarter. As LTPO TFT begins to be applied to the iPhone 17 series scheduled to be released in 2025, there are predictions that BOE’s initial panel supply will actually be difficult, and as BOE is unable to supply panels, the supply may be transferred to LG Display. However, since LG Display is currently producing panels close to full capacity, line expansion is necessary to produce more panels. There is an analysis that it is realistic to expand 6G lines because it is realistically difficult to quickly start investing in 8.6G.

Among Chinese panel companies, shipments of Everdisplay and Tianma increased. Tianma’s shipments increased, but only slightly, and Everdisplay’s shipments more than doubled to 13 million units compared to the previous quarter.

Samsung Display’s shipments decreased somewhat, but sales were similar to the second quarter, and BOE’s shipments were similar to the second quarter, but sales increased by 15%. In the fourth quarter, shipments from not only LG Display but also Samsung Display and BOE are expected to increase, and considering the characteristics of the OLED market with the highest shipment volume in the fourth quarter, global OLED shipments for smartphones are expected to exceed 800 million units in 2024.

Junho Kim, UBI Research analyst(alertriot@ubiresearch.com)

iPhone 17 series to be released in 2025, panels supplied by Samsung and LG Display, BOE still unknown

/in /by olednet

iPhone 17 Slim expected image (screen capture from @Apple Explained on YouTube)

It is expected that only two companies, Samsung Display and LG Display, will supply panels for the iPhone 17 series to be released next year. It is unclear whether BOE will be able to supply the new model, but it is expected that it will be difficult to obtain panel approval within 2025.

BOE was previously supplying the normal model iPhone 13~16 series. Although panel production for the iPhone 15 was temporarily halted in the middle of this year due to panel quality issues, it has resumed, and panels for the iPhone 16 have also been approved and are being mass-produced. However, unlike existing models where LTPO TFT was applied only to the Pro model, LTPO TFT is expected to start being supplied to all models starting from the iPhone 17 series. Accordingly, BOE, which lacks technology, will not be able to produce the normal model iPhone 17 in the early stages. It is expected to be difficult. In addition, it is expected that low-dielectric TFE will begin to be applied starting with the iPhone 17 series, but BOE is expected to have setbacks in the development of this technology.

As BOE’s volume decreases, Samsung Display and LG Display’s volume is expected to increase. Samsung Display is expected to produce all models of the iPhone 17 series, and LG Display is expected to produce the 17, 17 Slim (tentative name), and 17 Pro Max models. In 2025, Samsung Display is expected to produce 130 million panels for Apple, and LG Display is expected to produce 72 million panels. BOE plans to supply 65 million panels to Apple in 2025, but in reality, it is expected to supply 40 to 50 million panels, which is less than this.

Junho Kim, UBI Research analyst(alertriot@ubiresearch.com)

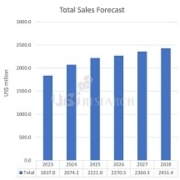

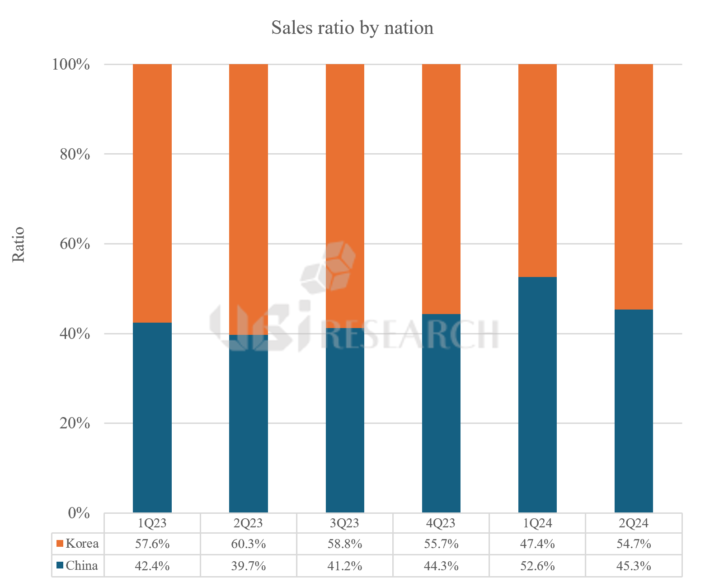

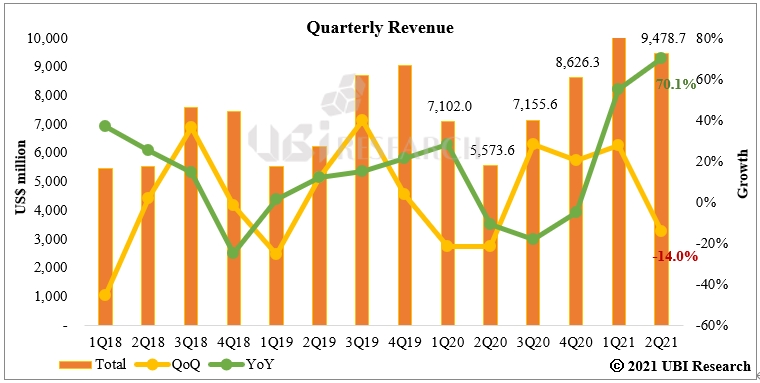

Korean OLED Panel Makers’ Emitting Material Purchases Reach 51.2% in H1, with a Modest Recovery Expected in H2

/in Material /by olednet

According to UBI Research’s recently published “3Q24 OLED Emitting Materials Market Track,” the purchase of emitting materials by Korean OLED panel manufacturers in the first half of 2024 totaled $495 million, representing 51.2% of the market share—a 7.8% decrease compared to the same period last year. This is a notable shift. Meanwhile, Chinese companies held 48.8% of the market share, up 7.8% year-on-year, with purchases amounting to $471 million.

As Chinese panel manufacturers ramp up shipments, the gap in the purchase of emitting materials between Korean and Chinese companies is steadily narrowing. In the first quarter of 2024, for the first time, Korean OLED panel companies’ share of emitting material purchases fell to 47.4%, lower than that of Chinese companies.

However, from the second quarter onward, with the increase in OLED panel shipments for IT devices and the production of panels for the iPhone 16 by Korean manufacturers, their share rebounded to 54.7%. While BOE passed the sample certification for the iPhone 16, the delay in mass production is expected to result in smaller shipments this year. Additionally, certification for the iPhone 16 Max, which was expected to be produced at BOE’s B12 factory, was not approved.

With the reduction in BOE’s iPhone shipments, Korean panel makers are likely to see an increase in panel shipments. Thanks to growing OLED panel orders from Apple for products like the iPhone and iPad Pro, Korean purchases of emitting materials are expected to rise to a 55.6% market share by the end of 2024, a notable increase compared to the first half of the year.

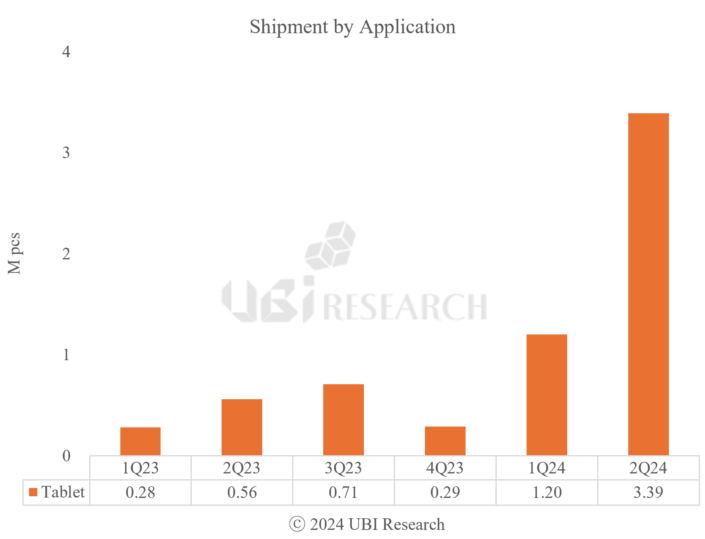

Due to the OLED iPad Pro for Tablet PC, shipments are rapidly increasing, and shipments are expected to increase by more than 6 times in 2024 compared to the previous year.

/in /by olednet

According to the “3Q24 Medium-Large OLED Display Market Track” published by UBI Research, more than 12 million OLEDs for tablet PCs are expected to be shipped in 2024 thanks to Apple’s entry into the OLED market for tablet PCs.

As mass production of iPad Pro OLEDs began in the first quarter of 2024, shipments of OLEDs for tablet PCs surged to 1.2 million units in the first quarter and 3.4 million units in the second quarter.

As not only Samsung Display and LG Display, but also Chinese panel manufacturers have begun mass production of OLEDs for tablet PCs, the OLED market for tablet PCs is expected to expand further. Among Chinese panel manufacturers, BOE is expected to ship about 1.5 million OLED panels for tablet PCs in 2024, and Visionox is expected to ship about 800,000 OLED panels for tablet PCs.

Due to the increase in panel shipments by Apple and Chinese companies, OLED shipments for tablet PCs are expected to exceed 30 million units in 2028.

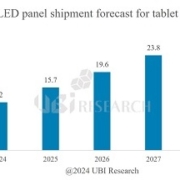

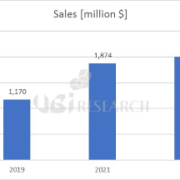

OLED market for Tablet PCs to grow 6-7 times by 2024 due to Apple’s entry

/in /by olednet

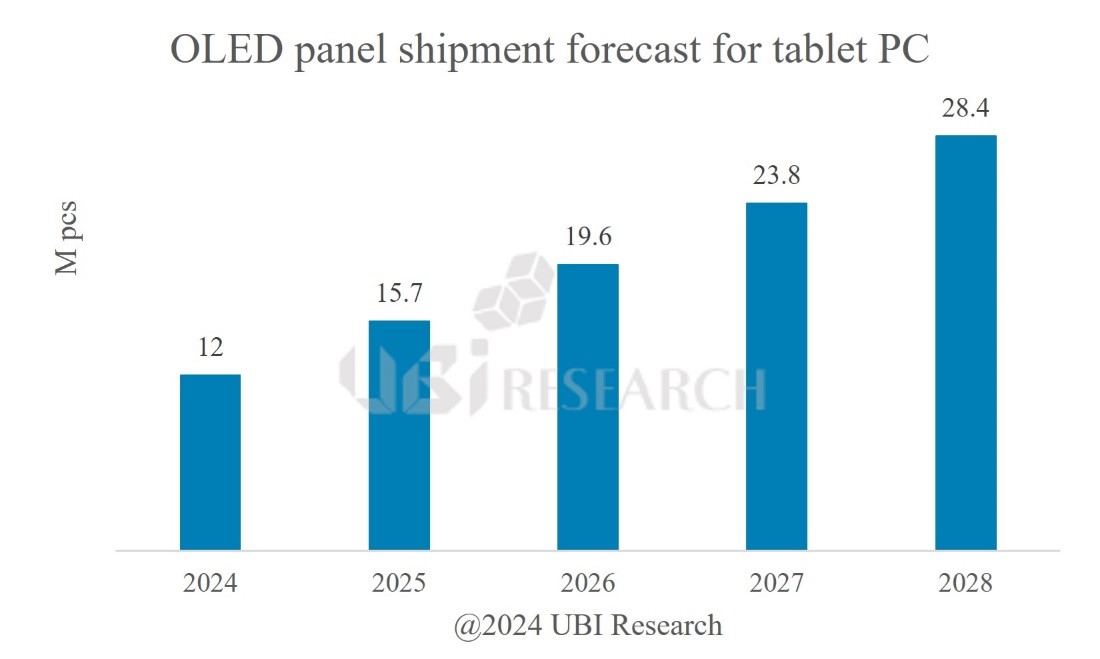

OLED panel shipment forecast for tablet PC

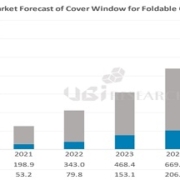

According to the ‘2024 Mid-Large OLED Display Annual Report’ recently published by UBI Research, shipments of OLED panels for tablet PCs are expected to grow from 12 million units in 2024 to 28.4 million units in 2028, with an average annual growth rate of 24.1%.

OLED panel shipments for tablet PCs were 1.3 million units in 2022 and 1.8 million units in 2023, forming a small market. However, with the decision to install OLED in the Apple’s iPad scheduled to be released in 2024, Samsung Display and LG Display are producing OLED panels for iPad-oriented table PCs.

Samsung Display produces panels for the 11-inch model and LG Display produces panels for the 12.9-inch model. Due to Apple’s entry, the OLED market for tablet PCs is expected to grow 6 to 7 times in 2024 compared to 2023.

In addition, panel companies are actively investing to apply OLED not only to tablet PCs but also to various IT products. Following Samsung Display’s recent investment in the 8.6G IT line, BOE also invested in the 8.6G IT line, and LG Display is also conducting a paid-in capital increase to secure funds for IT line investment and is planning to sell the Guangzhou LCD line. The OLED market for IT is expected to expand further due to the aggressive investment of panel companies.

International Business Conference: 2024 OLED Korea & 2024 eXtended Reality Korea will be held in parallel!

/in /by olednet

UBI Research, a display specialist research company, will hold the international business conferences OLED Korea and eXtended Reality Korea in parallel at The-K Hotel in Yangjae, Seoul from March 27 to 29, 2024. This event is expected to be an opportunity for people from companies, academia, and research institutes related to the display industry around the world to attend, exchange the best information, and form a global network.

eXtended Reality Korea is the first XR industry-related business conference held by UBI Research and will cover trends and outlook on micro display, XR Hardware/Software, materials, equipment, etc.

This event aims to provide attendees with the opportunity to deeply explore the display and XR areas through a comprehensive program including tutorials, keynote presentations, and panel discussions.

The tutorial on March 27th will feature presentations on the future of XR, micro LED display technology, and key technologies to realize the next generation OLED display.

In addition, keynote presentations by ▲UBI Research, ▲Samsung Display, ▲LG Display, ▲Hyundai Mobis, and ▲Fortell Games are scheduled for the conference to be held on March 28th and 29th. Choong-Hoon Yi, CEO of UBI Research, will give a presentation on “OLED and XR industry outlook.” We will present the overall OLED industry, including OLED for IT, and the micro OLED industry that will be applied to MR equipment.

Samsung Display plans to introduce SDC’s roadmap for expanding the AR/VR market based on SDC’s plan to overcome technical obstacles in ultra-high-resolution displays under the title “AR/VR Development Strategy for Future Display.”

Under the theme of “Life with OLED,” LG Display will examine the field of OLED displays applied in daily life and present the continuous evolution and benefits of OLED technology.

Under the theme of “Automotive Display / HUD Trend and Future Display,” Hyundai Mobis presents trends and requirements for automotive displays, from Pillar To Pillar displays to Rollable displays, predicts future automotive displays, and announces development strategies.

Lastly, Fortell Games will discuss the topic of “Next-Gen Mixed Reality: New Horizons for Spatial Computing”, analyzing the latest developments in mixed reality technology and their impact on the future of the gaming industry.

In addition, it will be run by a total of 34 domestic and foreign speakers and programs, including AR/VR development and technology, automotive displays, OLED industry, backplane technology, and MicroLED display development.

Because it is a parallel event, attendees can attend both events even if they register for one event, and registration is possible at a special discount price during the early bird period until February 29th.

Detailed information can be found on the website (https://oledkoreaconference.com/, https://extendedrealitykorea.com/).

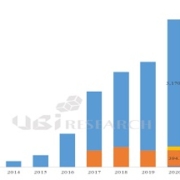

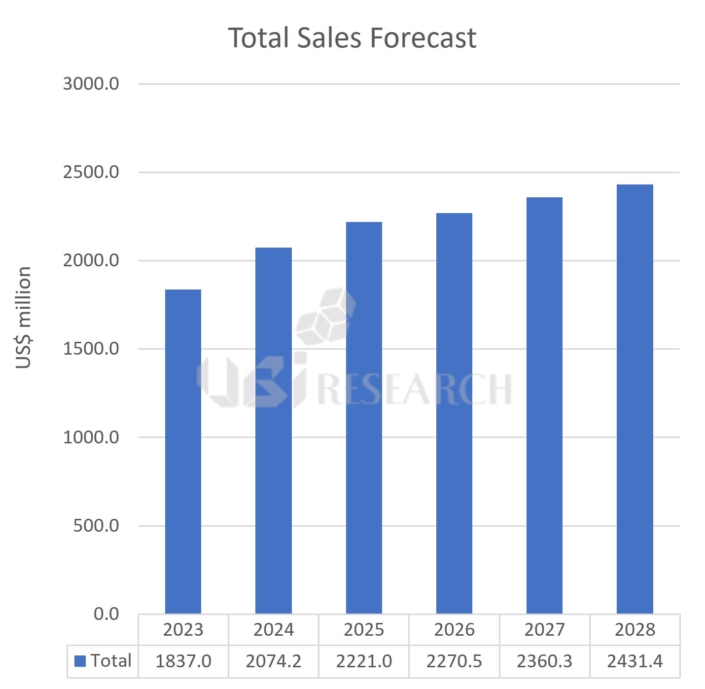

In 2028, the OLED emitting material market is expected to reach $2.43 billion with an average annual growth rate of 5.8%

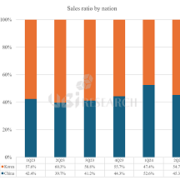

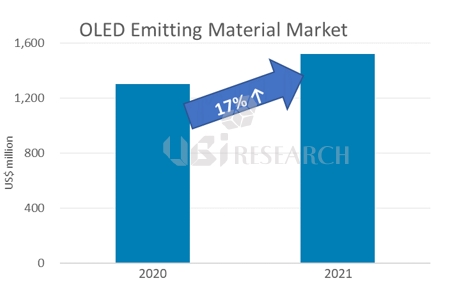

/in /by olednetAccording to the ‘4Q23_Quarterly OLED Emitting Material Market Tracker’ recently published by UBI Research, the market for emitting materials used in OLED is forecasted to grow from $1.84 billion in 2023 to $2.43 billion in 2028, with an average annual growth rate of 5.8%.

By country, Korean panel companies’ material purchases are expected to grow at an average annual growth rate of 4.2% from $1.11 billion in 2023 to $1.36 billion in 2028, and Chinese’ material purchases are expected to increase from $730 million in 2023 to $1.07 billion in 2028.

As forecasted, the material purchase ratio by country in 2028 will be 56% in Korea and 44% in China. However, Chinese panel companies are mainly mass producing panels for Chinese domestic use and white boxes, so even if panel shipments increase in the future, low-priced materials will be used. So, there is a possibility that the expansion of China’s emitting material market will be reduced further than currently expected.

Lastly, UBI Research predicted that Samsung Display’s purchase of emitting materials in 2028 will reach $810 million, LG Display’s will reach $550 million, and BOE will reach $440 million.

OLED emitting material market

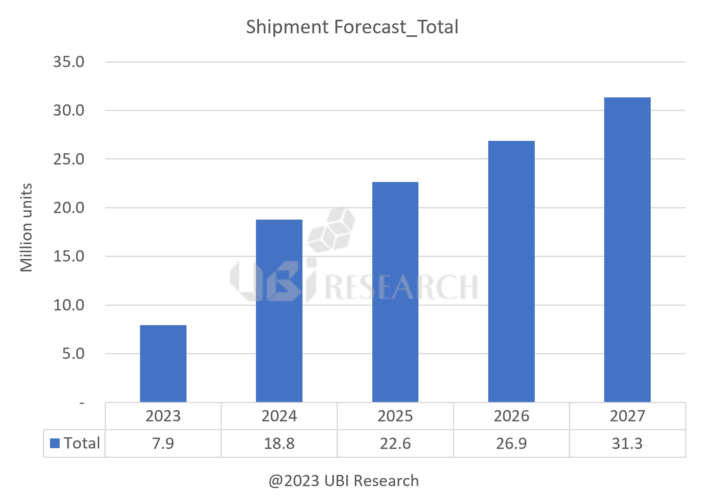

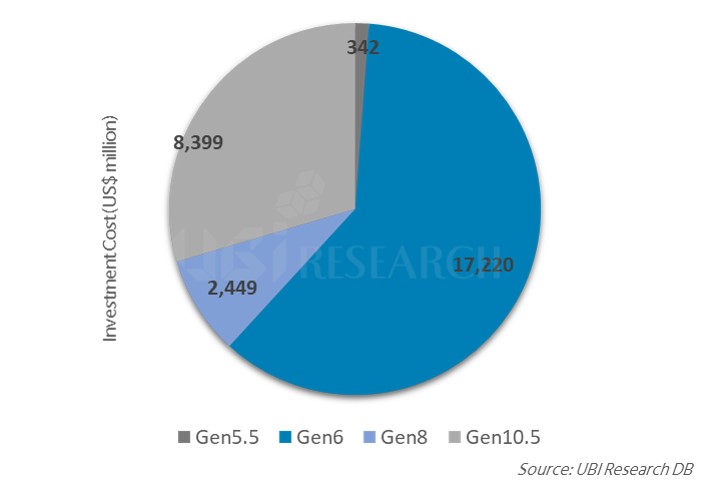

OLED shipments for IT are expected to reach 31 million units in 2027, with an average annual growth rate of 41%

/in /by olednetAccording to the ‘IT OLED Technology and Industry Trend Analysis Report’ recently published by UBI Research, OLED shipments for tablet PCs, notebooks, and monitors are expected to reach 31 million units in 2027 with an average annual growth rate of 41%.

This forecast is based on Samsung Display’s 5.5G OLED line, 6G OLED line, 8.5G QD-OLED line, 8.6G (2290 x 2620 mm2) IT line, and LG Display, BOE, and Visionox’s 6G OLED line.

Shipment forecast for IT OLED

For IT products, OLED had been a market that received less attention than smartphones or TVs, but has began to receive significant attention due to the increase in demand for IT products in COVID-19 and the prospect of Apple using OLED for IT products.

Previously, Samsung Display was mass producing a small amount of OLED for IT from some of A2 as the 5.5G rigid OLED line and the 8.5G QD-OLED line, and some Chinese companies such as EDO were producing IT OLEDs in small quantities, but in 2024, Samsung Display and LG Display plan to mass produce OLED for Apple’s iPad in earnest from the 6G line, and BOE also plans to mass produce OLED for IT from the B12 line.

In addition, Samsung Display decided to invest in the 8.6G OLED line for IT early this year, and is expected to mass produce various IT products, including notebooks, from the first half of 2026.

Moreover, LG Display and BOE are planning to invest in the 8.6G line as soon as they secure investment funds and customers, and Visionox is also reportedly holding meetings with major equipment companies to invest in the 8.6G line.

If demand for OLED from set companies for IT increases in the future and panel companies invest in 8.6G lines, the IT market is expected to become a new high value-added market for OLED, following the smartphone market.

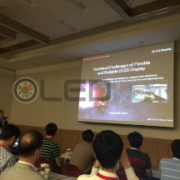

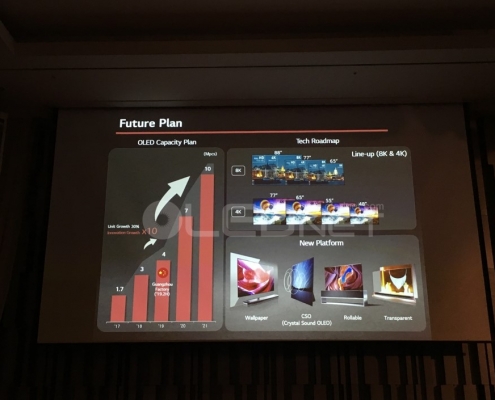

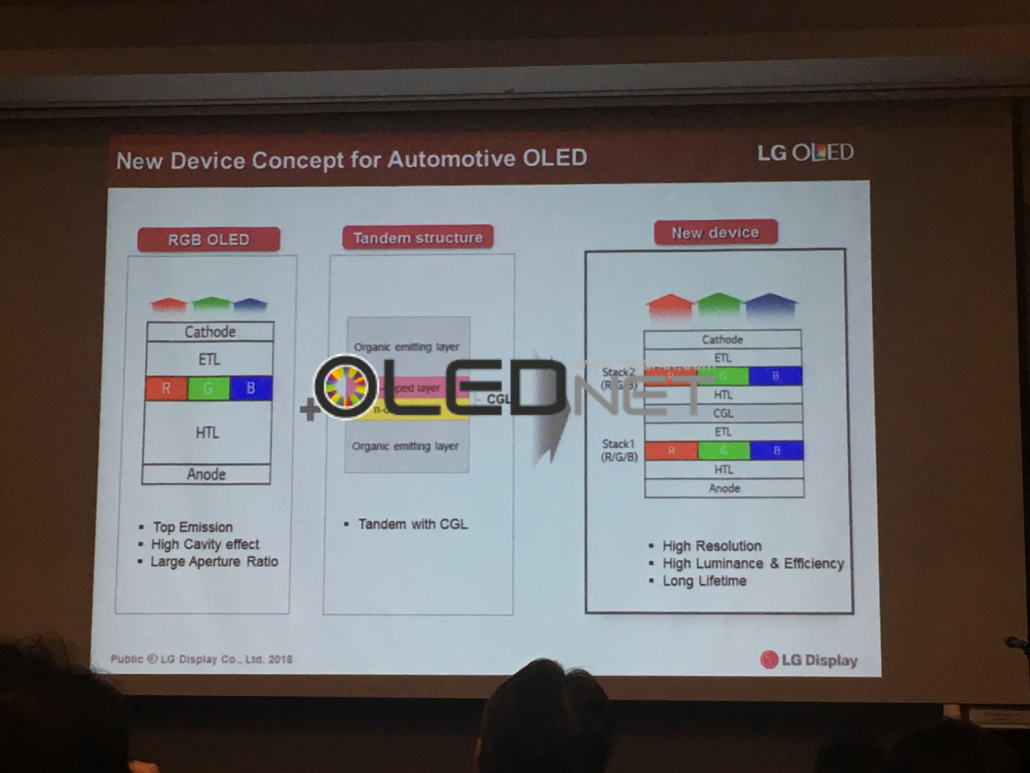

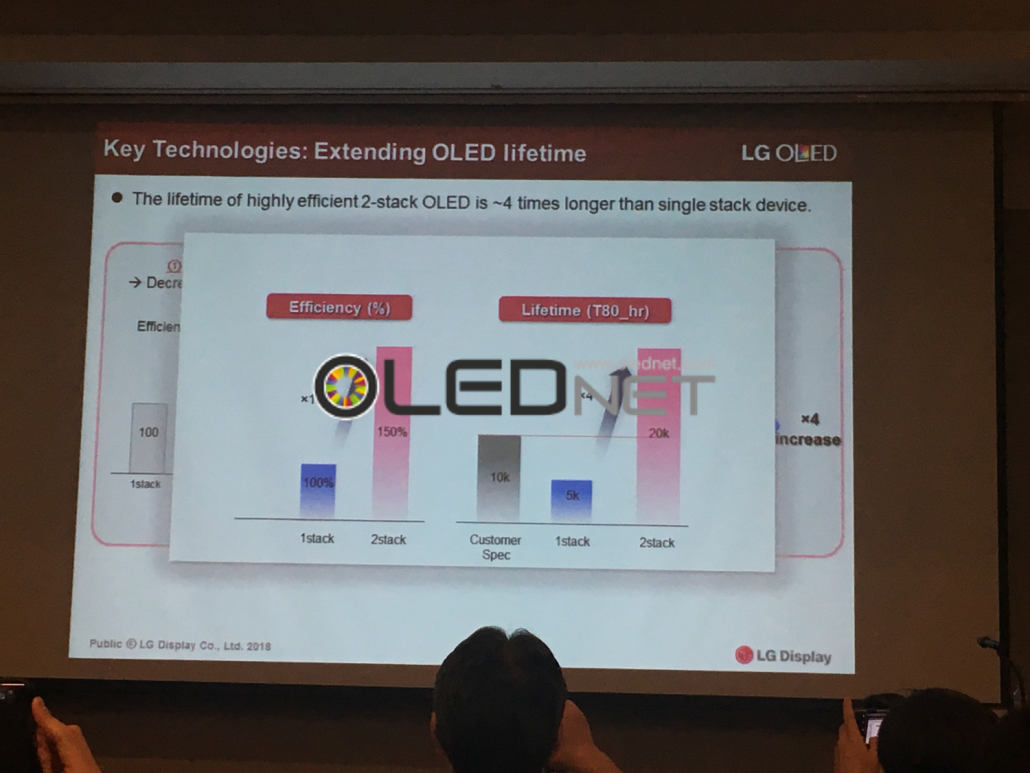

[IMID 2023 Keynote] LG Display’s automotive tandem OLED, applied to Hyundai Genesis

/in /by olednet

LG Display ‘Discovering the Best Automotive Display Solution for Tomorrow

At the ‘IMID 2023’ held in BEXCO, Busan on the 23rd, Kim Byeong-gu, head of LG Display’s Auto Business Group, gave a keynote speech on the theme of ‘Discovering the Best Automotive Display Solution for Tomorrow’.

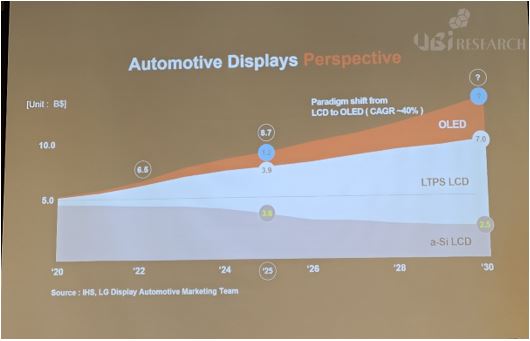

“The electric vehicle market is expected to grow 18% annually from the current 15 million units, reaching 50 million units annually by 2030,” said Kim, head of the group. He also predicted, “The automotive display market is expected to grow by 10% annually and reach a market of 12 billion dollars by 2030, and in particular, the automotive OLED market will show a high annual growth rate of 28%.”

The number of displays mounted on vehicles is increasing every year, and the size is increasing every year. Kim said, “The number of displays installed in vehicles increases every year, and by 2030, an average of 2.3 displays will be installed, and the average size will be over 15 inches.”. And He also mentioned, “We will manufacture large-size OLEDs for vehicles larger than 50 inches within a few years.”

LG Display ‘Discovering the Best Automotive Display Solution for Tomorrow

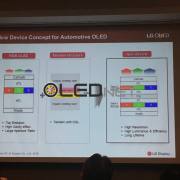

Currently, LG Display is supplying luxury flagship P-OLED, premium OLED ATO (Advanced Thin OLED), and low-end LTPS LCD as automotive displays.

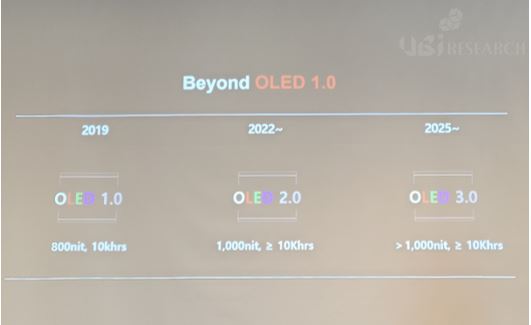

Group leader Kim said, “LG Display, after mass-producing the world’s first automotive tandem OLED in 2019, has developed and mass-produced ‘Tandem OLED 2.0,’ which improves brightness by 30% and reduces power consumption by 40% in 2023. And LG Display is developing ‘Tandem OLED 3.0’, which improves luminance by 20% and power consumption by 20% from the second generation.”

LG Display ‘Discovering the Best Automotive Display Solution for Tomorrow

Following this, Group Head Kim disclosed LG Display’s tandem OLED customers, such as Genesis, Mercedes-Benz, GM, Volvo, and Jaguar. Group leader Kim emphasized the Genesis of Hyundai Motor Company and emphasized, “We have been developing cooperation with Hyundai Motor Group for two years, and sooner or later, Genesis with LG Display’s tandem OLED will appear.”

Lastly, Group Head Kim said, “Based on continuous customer value realization and high-quality orders based on future technologies, LG Display will have a share of more than 50% in the automotive display market in 2026, excluding a-si LCD, and 60% in the automotive OLED display market.”

[IMID 2023] OLED exhibited by Samsung Display and LG Display

/in /by olednetAt ‘IMID 2023’ held in BEXCO, Busan on August 22, Samsung Display and LG Display exhibited a number of OLED products.

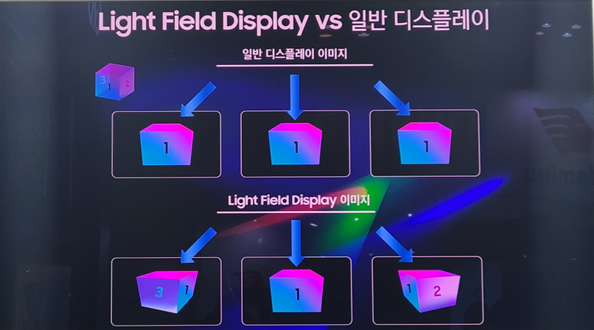

First, in ‘IMID 2023’, Samsung Display introduced 77-inch QD-OLED and light field display ‘2D↔3D Display’, ‘Slidable Flex Solo’ and ‘Slidable Flex Duet’, ‘Rollable Flex’, ‘Flex G’, ‘Flex It exhibited foldable and sliderable products such as ‘S’ and ‘Flex Note’. Products other than ‘2D↔3D Display’ were exhibited at ‘K-Display 2023’ held last week, and the exhibition scale was smaller than ‘K-Display 2023’.

Samsung Display 2D↔3D Display

Samsung DIsplay Light Field Display

The size of the ‘2D↔3D Display’ exhibited by Samsung Display was 16 inches, the panel resolution was 3840×2400, and eyetracking technology was inserted to support a 3D viewing angle of more than 40°.

LG Display’s 77-inch 8K OLED with ‘META Technology’ applied, 45-inch and 27-inch gaming OLED, ‘34” Full Dashboard OLED’, ‘18” Rollable OLED’, ‘15.6” Light Field Display’, ‘0.42” OLEDoS’ exhibited.

LG Display Rollable OLED

The 18-inch rollable OLED, which LG Display unveiled for the first time in Korea, realized a brighter screen by applying a tandem element structure, and passed more than 100,000 rolling tests. The resolution of the ‘18” Rollable OLED’ is 2560×1440, the brightness is 1,000nits, the rolling radius is 20R, and the cover window material is TPU (Thermoplastic Poly Urethane). An official from LG Display said, “There is no plan to mass-produce 18-inch rollable OLED yet, and the rolling radius will be between 5 and 10R when mass-producing actual products.”

‘0.42” OLEDoS (OLED on silicon)’, an ultra-high resolution product with 3500ppi, was the same as the product exhibited at ‘K-Display 2023’. It is a product that combines the optical system of LetinAR, a domestic optical module developer, with the panel of LG Display.

LG Display “A significant portion of the panel inventory adjustment that has been ongoing since last year is expected to turn profitable in the 4th quarter”

/in /by olednet

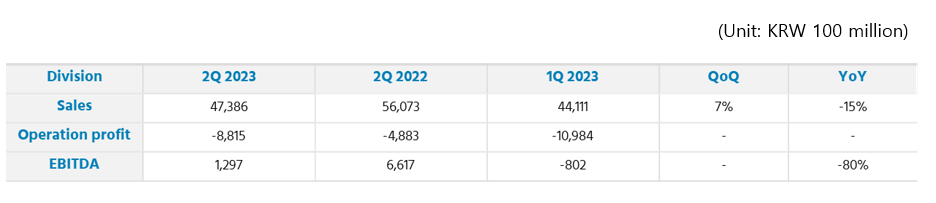

LG Display’s 2Q 2023 Performance Summary

In a conference call on LG Display’s Q2 2023 earnings announcement held on the 26th, LG Display CFO Seong-Hyeon Kim announced, “As a significant portion of panel inventory adjustments have been made, a turnaround is expected in the fourth quarter of this year.”

Since last year, intensive inventory adjustments in downstream industries have continued, centering on TV and IT products, and panel inventory levels across the industry ecosystem have been declining. In the second quarter, demand for mid- to large-sized panels, including OLED TVs, increased and shipments expanded. Compared to the previous quarter, shipment area increased by 11% and sales increased by 7%.

Sales by product (based on sales) in the second quarter were 24% for TV panels, 42% for IT panels (monitors, laptops, tablet PCs, etc.), 23% for mobile panels and other products, and 11% for automobile panels.

LG Display plans to continue to promote ‘advanced business structure’ centered on ‘order-based business’ and expand the proportion of OLED business. It plans to further increase the proportion of OLED and business competitiveness in all large- and small- and medium-sized products. This year, OLED sales are expected to exceed 50%.

In the small and medium-sized OLED sector, it plans to make efforts to expand mobile product shipments based on the expanded production capacity, while further solidifying its leadership in IT OLED technology and preparing for mass production and supply systems in 2024 without a hitch. The automotive display business plans to focus on increasing sales and order receipts based on various and differentiated technological competitiveness that encompasses tandem OLED and high-end LCD.

Kim Seong-hyun, CFO of LG Display, said, “It is judged that the inventory adjustment of downstream industries, which has been ongoing since last year, has progressed considerably since the first half of the year.” Thanks to the expansion of order-based business performance, such as increased shipments, we expect a turnaround in the fourth quarter.”

LG Display announced that it recorded sales of KRW 4,738.6 billion and operating loss of KRW 881.5 billion in the second quarter of 2023.

OLED panel makers’ 8.6G IT line investment trends, LG Display and BOE’s investment delays

/in /by olednet

Apple iPad Pro

Samsung Display and LG Display are investing in the 8.6th generation IT line with high added value to compensate for the decrease in sales due to the Chinese panel makers’ flexible OLED low-cost offensive and LCD withdrawal.

At the LG Display 2Q earnings announcement conference call held on the 26th, an official from LG Display said, “The announced 6th generation IT-related investments are proceeding as scheduled, and the investments will be made until the first half of next year.”

However, regarding the possibility of investing in the 8.6th generation IT OLED, it stated that “nothing has been confirmed yet”. LG Display emphasized, “We will carefully look at the possibility and progress of technology development and whether market demand is developing to a level that can contribute to the company’s profits before making an investment decision.”

LG Display’s 8.6th generation IT line investment is expected to be delayed compared to Samsung Display due to difficulties in securing new line investment funds due to operating losses, but it is expected to be able to supply panels to Apple from 2026.

Not only LG Display, but also Chinese panel maker BOE’s investment is being delayed. Samsung Display can secure Samsung Electronics and Apple, and LG Display can secure LG Electronics and Apple as customers, but BOE is expected to take at least two years to invest in the 8.6G line for IT because of uncertainty in securing customers.

Another Chinese panel maker, Visionox, is also preparing to invest in the 8.6G line for IT. Visionox plans to announce its investment in the 8.6th generation line with a total capacity of 30K in September.

On the other hand, Samsung Display’s investment in the 8.6th generation IT line has already been decided. Samsung Display plans to apply Oxide to the TFT of the 8.6th generation IT line and build it with 2 stack RGB OLED. Samsung Display had previously developed 8.6th generation vertical deposition 2 stack RGB OLED as an IT line, but the investment was decided for 8.6th generation horizontal deposition. Canon’s exposure machine is planned to be brought into Samsung Display’s IT line in April 2024, and negotiations on the price of the deposition machine with Canon Tokki have already been completed.

Choong Hoon YI, CEO of UBI Research “Samsung Display will strengthen profitability by producing OLED for high value-added IT”

/in /by olednetIt is expected that Samsung Display will focus on producing panels for tablet PCs and notebooks to compensate for the reduced utilization rate of the A2 line due to the low-cost flexible OLED offensive of Chinese panel makers.

At the ‘2023 OLED & Micro Display Analyst Seminar’ held at the Federation of Korean Industries in Yeouido on the 5th, Choong Hoon YI, CEO of UBI Research, gave a presentation on ‘IT OLED industry trends and market prospects’.

Choong Hoon YI, CEO of UBI Research

CEO YI said, “Samsung Display is expected to focus on rigid OLED production for tablet PCs and notebooks to compensate for the reduced utilization rate of the A2 line due to the low-priced offensive of Chinese companies. As much as it focuses on IT OLED production, the shipment of rigid OLED for smartphones will drop sharply, but it is possible to maintain sales by producing rigid OLED for IT with high added value.” And he also said, “LG Display will start mass production one year later than Samsung Display, and BOE will start mass production at least two years later than Samsung Display.”

According to CEO Choong Hoon YI, LG Display’s decision is being delayed because it is difficult to secure funds for investment in new lines due to the deficit caused by the delay in switching from LCD lines to OLED lines. Nevertheless, LG Display is expected to be able to supply IT panels to Apple from 2026. However, there are still problems to be solved, such as stabilizing the process and securing yield of Sunic system equipment whose production capacity has not yet been verified.

BOE has invested in three OLED line factories for smartphones, but the operation rate is at a level of only one factory, and the Beijing city government is very dissatisfied with over-investment due to insufficient securing of Apple supplies. For the reasons mentioned above and because securing customers for IT OLED has not been decided, BOE’s IT OLED line investment is expected to take at least two years.

CEO YI said, “Chinese panel makers are trying to increase their market share with low-priced attacks, but domestic companies that have secured large customers such as Samsung Electronics and Apple have a significant advantage in competition. In the future, the OLED industry for TV and IT will be developed mainly by Korean companies.”

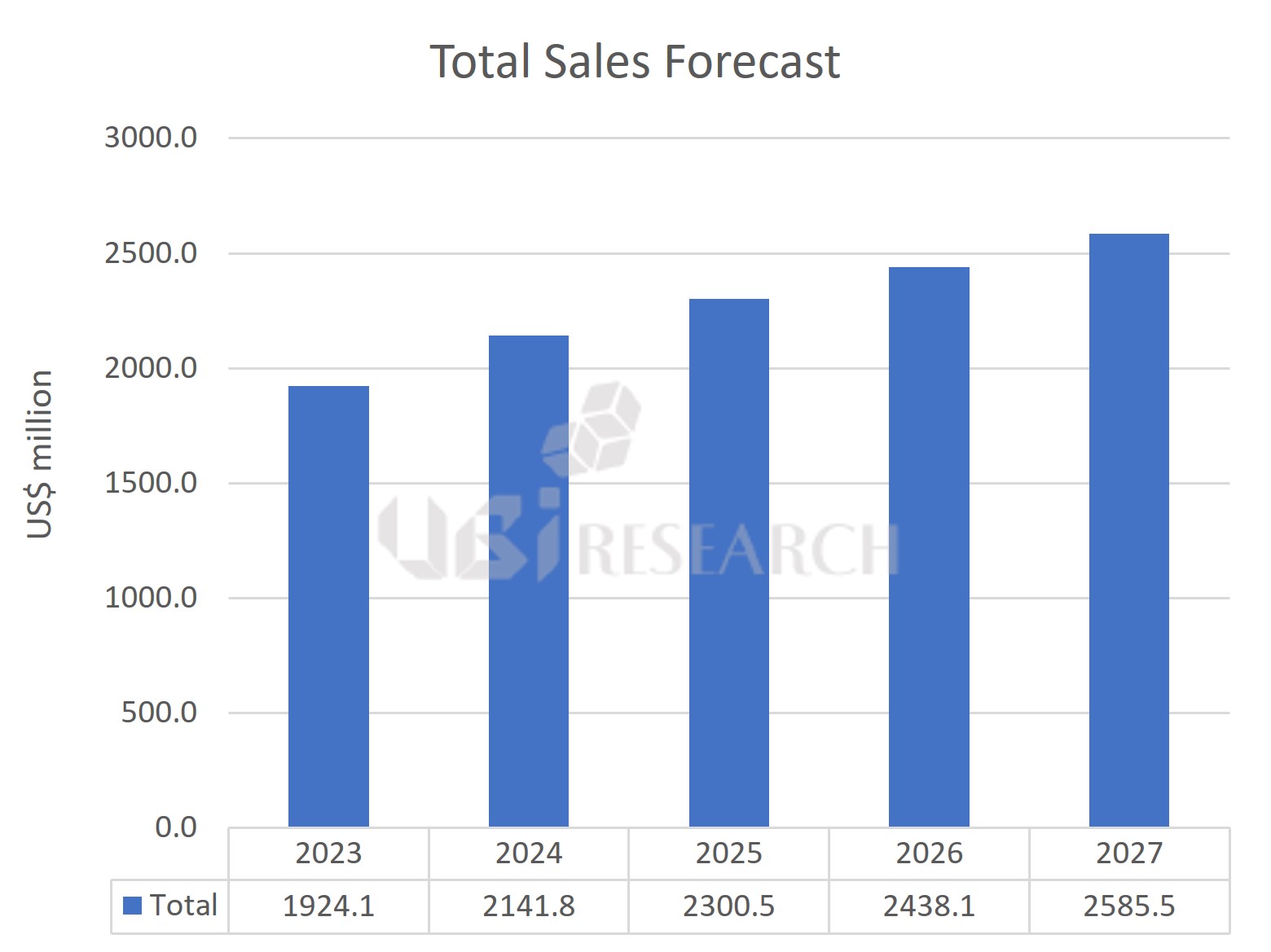

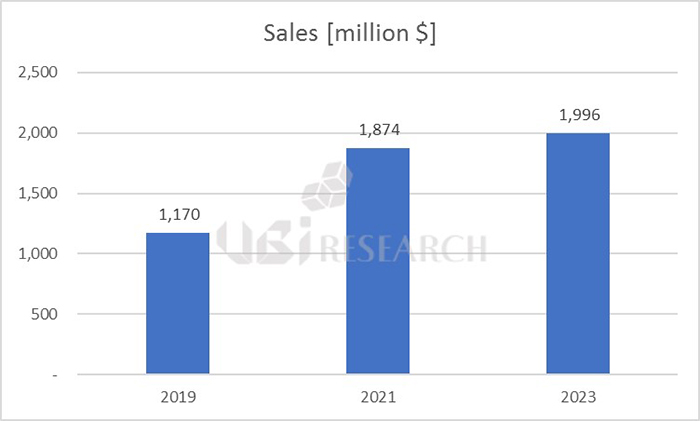

OLED emitting materials market in 2027 expected to reach US$ 2.59 billion with an average annual growth rate of 7.7%

/in /by olednetAccording to the ‘2023 OLED Emitting Material Report’ recently published by UBI Research, the total emitting material market is expected to reach US$ 2.59 billion in 2027 with an average annual growth rate of 7.7% from US$ 1.92 billion in 2023.

total emitting material market

Analyst Yoon Daejeong of UBI Research said, “The small OLED material market is expected to grow at an average annual growth rate of 2.5% from 2023 to US$ 1.61 billion in 2027. And in 2027, Samsung Display’s purchase of small OLED materials is expected to be US$ 560 million, BOE US$ 430 million, and LG Display US$ 200 million.” and “the small OLED material market will change depending on how much the foldable OLED market replaces the sharp decline in rigid OLED shipments for smartphones.

Analyst Yoon continued, “As the shipments of LG Display’s WOLED and Samsung Display’s QD-OLED are expected to be 12 million units and 3 million units, respectively, in the large OLED material market in 2027, the purchase amount of emitting materials is also expected to be US$ 430 million and US$ 140 million, respectively”

Meanwhile, the report predicted that by OLED method in 2027, RGB OLED would occupy the largest share at 66.6%, followed by WOLED at 16.5%, RGB 2stack OLED at 11.4%, and QD-OLED at 5.5%.

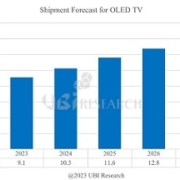

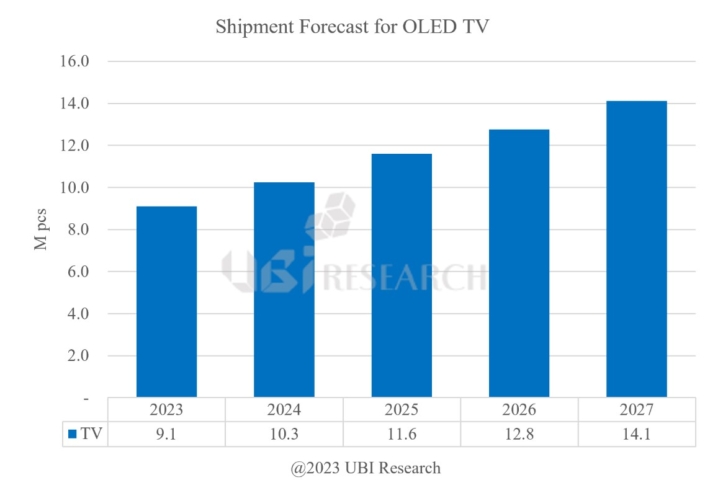

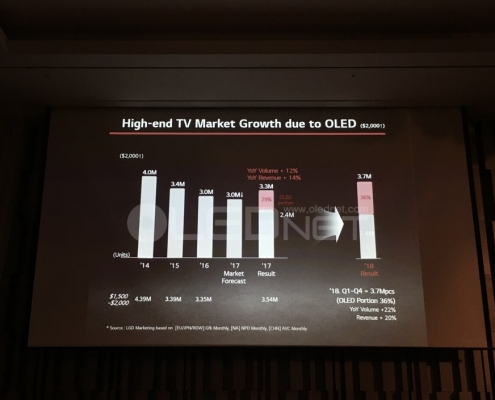

OLED panel shipments for TVs are expected to reach 14.1 million units in 2027 with an average annual growth rate of 11.6% from 9.1 million units in 2023

/in /by olednetAccording to the ‘2023 Medium and Large OLED Annual Report’ recently published by UBI Research, OLED panel shipments for TVs are expected to grow from 9.1 million units in 2023 to 14.1 million units in 2027 with an average annual growth rate of 11.6%.

Shipment Forecast for OLED TV

In 2022, it is analyzed that TV demand will decline due to the global economic deterioration, and global TV shipments will also stop at the early 200 million units. In the case of LG Display, it set a goal to ship more than 10 million WOLEDs in early 2022, including those for monitors, but released a total of 6.96 million units, recording a decrease of 880,000 units from 7.84 million units in 2021. Samsung Display’s QD-OLED shipments for TVs are also analyzed to have recorded 950,000 units.

As the economic situation is expected to gradually recover in 2023, LG Display’s TV WOLED shipments are expected to be 7.6 million units and Samsung Display’s QD-OLED shipments to be 1.5 million units.

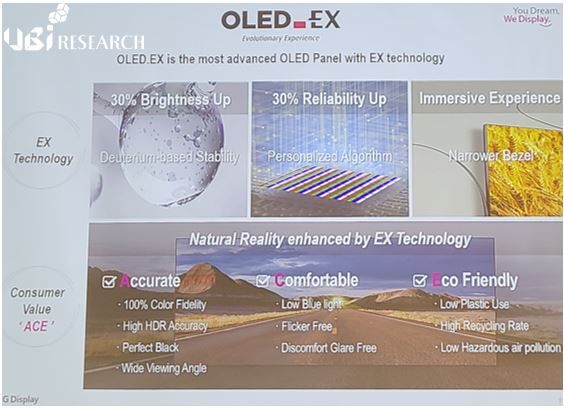

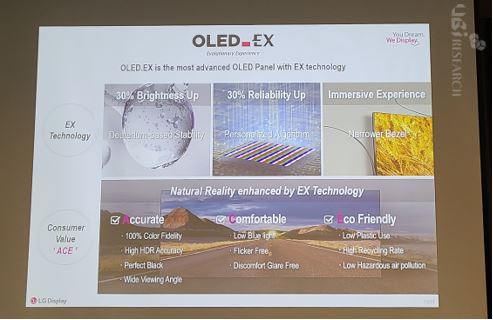

Meanwhile, UBI Research predicted that LG Display’s micro lens array (MLA) applied ‘OLED.EX’ panel would be partially mass-produced from 2023, and Samsung Display’s QD-OLED monthly capacity of 36K is expected to be 41K per month by the second half of 2023 and 45K per month by the first half of 2024.

2023 OLED KOREA Conference “OLED, a premium electronic product lineup and micro display, a promising future industry”

/in /by olednetOLED KOREA, hosted by UBI Research, a market research company, will be held at the Central Park Hotel in Songdo, Incheon from April 12 to 14. OLED KOREA, which marks its 7th anniversary, is a business conference where top authorities in display from Korea, Japan, Asia, the United States, and Europe gather.

This conference will deal with the topics of OLED, which has become a premium electronic product, and micro-display for AR and VR, which are rapidly emerging as future industries.

In order for OLED to replace LCD, the emergence of phosphorescent blue materials is the most important. At this conference, Samsung Advanced Institute of Technology and UDC will introduce the direction of phosphorescent material development. Commercialization of phosphorescent blue materials will be an inflection point that can overturn the display industry.

There are two types of micro displays: micro OLED and micro LED. While micro OLED is leading the way for VR, micro LED is gradually taking its place in AR. In OLED KOREA, programs are composed of AR companies, micro display manufacturers, and related technology companies. It will be an important place to guess who will be the winner of the future micro display.

The pre-registration period for this conference is until April 7, 2023, and you can check program and speaker information and register for the event through the website (https://oledkoreaconference.com/).

LG Display strengthens its transparent OLED lineup by launching 77-inch transparent OLED this year

/in /by olednet

LG Display at 2023 display technology roadmap

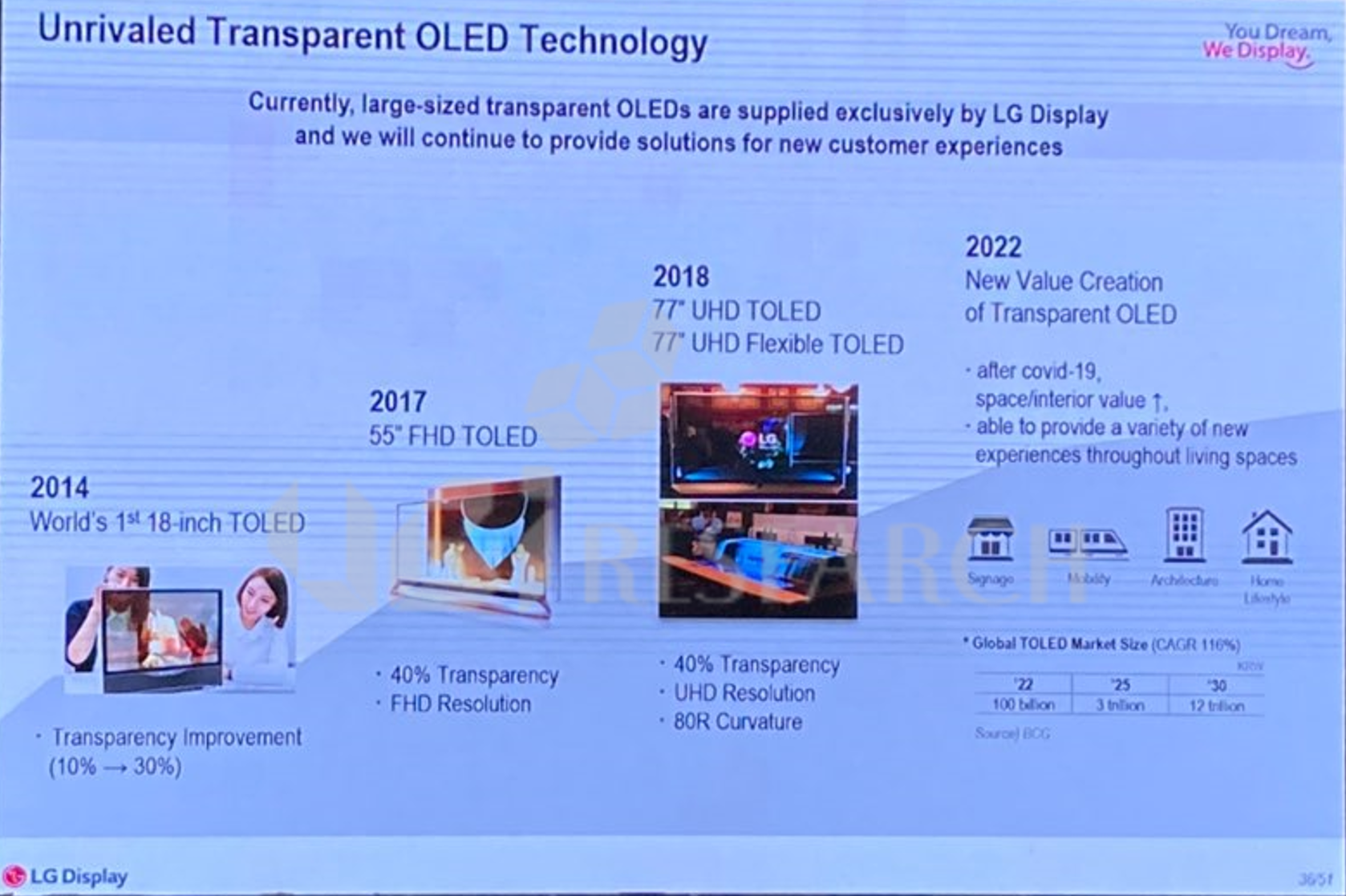

LG Display announced that it will release 77-inch transparent OLED products by the end of this year. LG Display plans to continuously strengthen its transparent OLED product lineup, which is a next-generation technology.

At the presentation of the 2023 display technology roadmap held at the Korea Chamber of Commerce and Industry on the 21st, Yeo Joon-ho, group manager of LG Display, said, “In addition to the 55-inch size that is currently being released as transparent OLED, we plan to release 77-inch transparent OLED products by the end of 2023.”

LG Display Transparent OLED

Emphasized that “transparent OLED can create a sense of openness that can connect spaces and create new spaces and advertising areas,” adding, “Recently, interior-friendly designs are in the limelight. We have tried many ways to realize the needs of consumers, and if we meet them, we will be able to open consumers’ wallets even at high prices.”

Finally, “LG Display is currently a B2B company, and transparent OLED products are being sold to B2B customers rather than B2C. In the future, we plan to expand the scope to B2C customers.” Group leader Yeo said, “The reaction to transparent OLED in Europe and the US was not bad. However, since the transparent OLED market is centered on B2B, there has not yet been a case where a large unit of volume explodes at once. We are thinking about how to effectively continue our fragmented business.”

LG Display, Already completed development of OLEDoS-applied prototype for VR

/in /by olednet

LG Display presenting OLEDoS at OLED School

At the 19th OLED School held at Sookmyung Women’s University from February 9th to 10th, Senior Research Fellow Yoo Chung-geun of LG Display announced, “We are developing a set for VR using OLEDoS, and some of the prototypes have already been developed.”

On this day, Research Fellow Choong-Keun Yoo gave a presentation on ‘The Future of OLED Display, Metaverse and Display’. Researcher Yu explained the specifications and technologies required for micro displays such as metaverse and VR/AR, and said, “In general VR devices, luminance of 10,000 nits or more and AR devices require luminance of 100,000 nits or more, but it is difficult to apply this to OLEDoS. Currently, the display for AR developed by LG Display has achieved a brightness of over 7,000 nits and a resolution of 3,500 ppi.”

LG Display OLEDoS Manufacturing Process

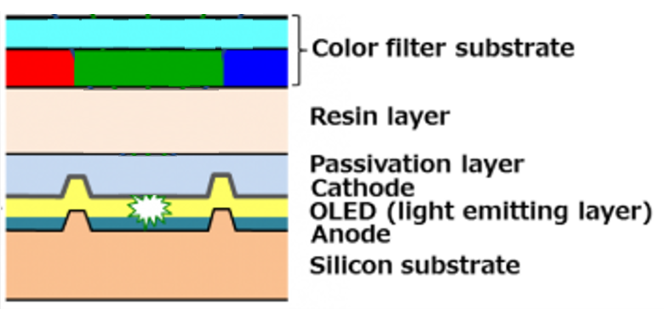

3500ppi or higher OLEDoS being developed by LG Display requires ultra-high-definition patterns, so Si-wafer backplane and WOLED + CoE technology must be applied, so cooperation with semiconductor foundries is essential. Research Fellow Yu explained, “For high-resolution OLEDoS, semiconductor foundries have no choice but to make display backplanes through wafers.”

Finally, researcher Yoo said, “We are developing a set for VR using OLEDoS, and it is planned to be released soon. We are developing products for major IT companies such as Apple, Google, and Meta, and some prototypes have already been developed.” He continued, “It takes more time to supply products that meet consumer needs, such as brightness of 10,000 nits or more, but it is possible to produce better VR devices even with 3500ppi class OLEDoS, which has now been developed.” When asked if the next actual product supply time was right before September, he replied, “There is nothing planned yet.”

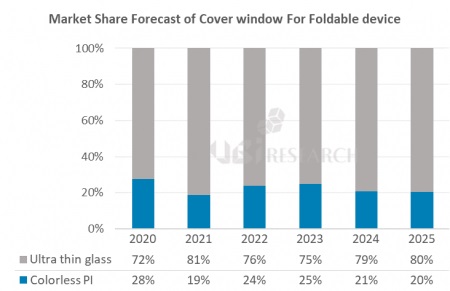

Fold, extend… Foldable IT device trends seen through exhibition trends

/in /by olednetAs panel makers have recently accelerated the development of foldable OLEDs, a variety of products, including foldable phones, foldable tablet PCs, and foldable laptops, are being exhibited. We look at the development trend based on the exhibited products of panel makers.

‘Flex Hybrid’ and ‘Slidable Flex Duet’ exhibited by Samsung Display

At CES 2023, which was held in January, Samsung Display, a leader in foldable displays, exhibited the ‘Flex Hybrid’, a combination of foldable and slider, and the ‘Slidable Flex Solo’, which extends on one side and, the ‘Slidable Flex Duo’, which extends on both sides. In the ‘Flex Hybrid’, the screen expands from the default 8 inches to 10.5 inches when the folded screen is unfolded, and to 12.4 inches when the right side is extended. Sliderable products can expand the screen from the basic 13 to 14 inches to 17 inches.

Prior to this, Samsung Display had exhibited S-type and G-type, double-folding ‘Flex S’ and ‘Flex G’, and ‘Slidable Wide’ that extends outward in 2022, and all three products had a maximum size of 12.4 inches. The size of the prototypes is 12.4 inches, which is the same as Samsung Electronics’ Galaxy Tab S8+. When mass-producing actual products, it is expected that mass-production will be carried out according to the needs of set makers.

Foldable OLED for laptops from Samsung Display, LG Display, and BOE

In addition to tablet PCs, foldable laptops are also being developed. Samsung Display exhibited the 17.3-inch foldable OLED ‘Flex Note’ for laptops at IMID 2022 and SID 2022. Originally, Samsung Display was expected to supply this 17.3-inch foldable OLED to Samsung Electronics last year, but the schedule was delayed to this year.

LG Display is also developing a foldable OLED for 17.3-inch laptops. LG Display exhibited a 17.3-inch ‘Foldable OLED Laptop’ with an improved folding radius of 1.5R at IMID 2022. LG Display is currently developing foldable OLED for laptops with the goal of supplying HP.

BOE of China is also developing foldable OLED for IT. BOE exhibited a 12.3-inch foldable OLED for tablet PCs that double-folds into an S-type at SID 2022 in May of last year. It also unveiled a foldable OLED for 17.3-inch laptops, and this panel was mounted on Asus’s ‘ZenBook 17 Fold’ released in 2022.

Samsung Display, LG Display, and BOE are all developing foldable OLEDs for notebooks in the same size and resolution. When full-scale mass production begins, competition for panel supply between the three companies is expected to be fierce.

LG Display Expected to Supply only LTPO Panels for iPhone 15 to be Released in 2023

/in /by olednet

iPhone 15 expected lineup

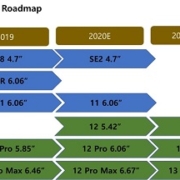

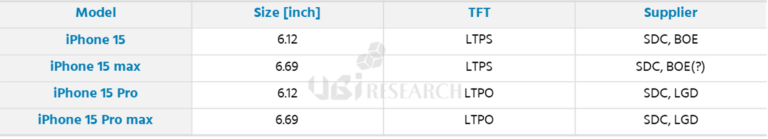

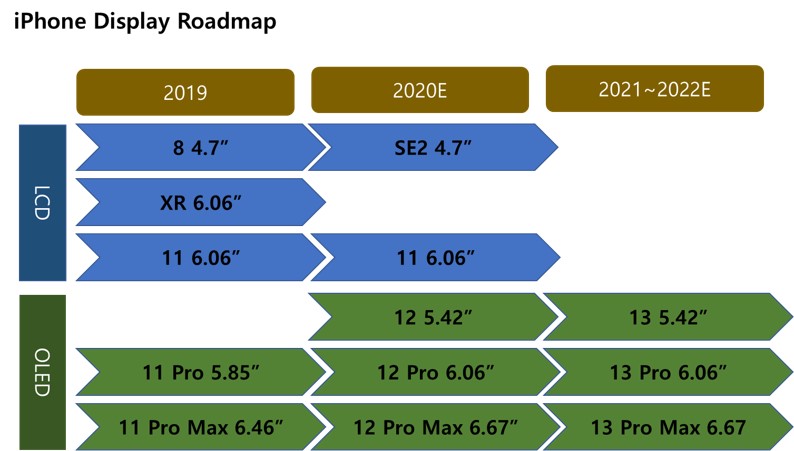

It is forecasted that LG Display will supply only two panels of the LTPO model among the iPhone 15 series to be released in 2023. It is unlikely that panels will be supplied to 6.1 inch LTPS models that have previously supplied panels. LG Display first started supplying OLED panels for the iPhone11 Pro max released in 2019 and supplied LTPO TFT-applied panels for the first time for the iPhone14 Pro max released this year.

According to the prospect that LG Display will supply LTPO panels for iPhone 15 to be released next year, Samsung Display and LG Display will jointly supply LTPO models. Samsung Display is expected to supply panels for all 4 types of iPhone15, LG Display for 2 pro models, and BOE for 6.1-inch LTPS models. It is still unknown whether BOE will supply panels for the 6.7-inch LTPS model.

It was in 2017 that Apple began to apply OLED to iPhone. LTPO TFT was applied from the iPhone13 pro series released last year and LTPO TFT applied panel was supplied to Apple for the first time by Samsung Display.

[IFA 2022] LG Display Booth

/in /by olednet#ifa2022 #lgdisplay #oledtv

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

[K-Display 2022] LG Display creates new value with transparent OLED

/in /by olednetAt ‘K-Display 2022’ held from August 10 to 12, LG Display exhibited various transparent OLED products such as wall type and TV type. The transparent OLED exhibited this time had a transmittance of 45% and a resolution of FHD level.

LG Display’s transparent OLED exhibited at K-Display 2022

At the ‘Display BUSINESS Forum 2022’ held on the 11th, Kang Won-seok, managing director of LG Display, said that the use of transparent OLEDs is increasing due to improved transmittance and reduced weight.

Director Kang mentioned that LG Display has been developing transparent OLED since 2014, and announced that he would increase the value of transparent OLED in line with internal activities that have been increasing since COVID-19.

LG Display Transparent OLED Roadmap

Currently, LG Display is mass-producing transparent OLED on a limited basis in its E3 line. Currently, only 55-inch transparent OLEDs are being mass-produced, but from the second half of this year, they plan to expand the lineup to 77 inches.

LG Display’s transparent OLED is mainly used for museums and signage in China. As demand is expected to increase in the future, LG Display is expected to respond to the market by lowering panel prices and introducing production lines other than E3.

[K-Display 2022] LG Display Online Booth Tour

/in Oled Video, Oled Video, Oled Video /by olednetThis is the LG Display booth exhibited at K-Display 2022.

LG Display exhibited OLED.EX, transparent OLED, and various concept OLED products.

I hope it will be of some help to those who could not attend K-Display 2022.

▶ UBI Research official website

https://ubiresearch.com/en/

▶Business, display report inquiry

marketing@ubiresearch.com

+82-2-577-4391

▶If you are curious about the latest news related to OLED?

https://en.olednet.com/

[K-Display 2022] LG Display’s Transparent OLED

/in /by olednetThis is LG Display’s new transparent OLED display.

It was amazing to actually see the technology we saw in sci-fi movies when we were young.

How can LG Display’s transparent OLED be applied to our lives?

▶ UBI Research official website

https://ubiresearch.com/en/

▶Business, display report inquiry

marketing@ubiresearch.com

+82-2-577-4391

▶If you are curious about the latest news related to OLED?

https://en.olednet.com/

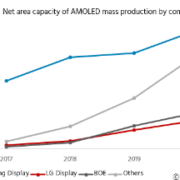

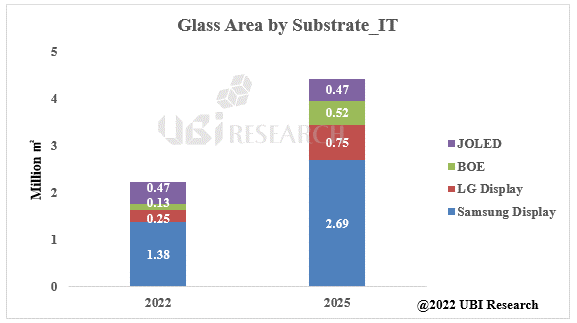

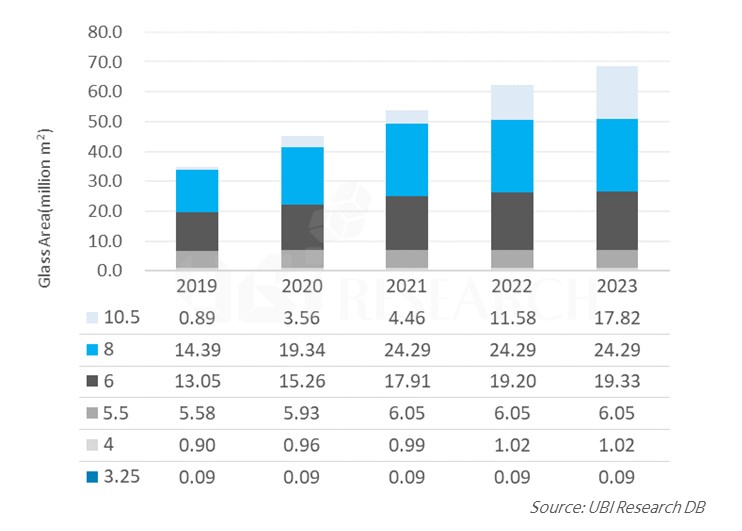

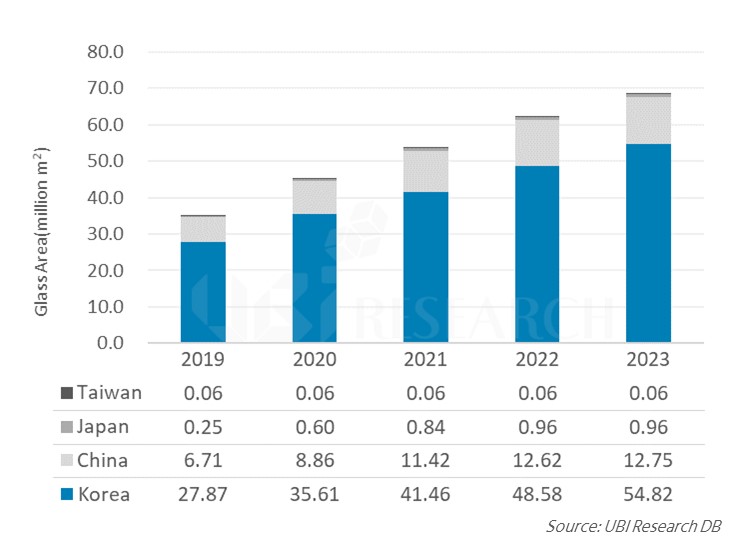

This Year’s OLED Mass Production Capacity Substrate Area is Expected to be 47.3 million ㎡

/in /by olednetAccording to the ‘2022 OLED Components and Materials Report’ recently published by UBI Research (www.ubiresearch.com), a company specialized in OLED market research, the substrate area of the total OLED mass production capacity in 2022 is expected to be 47.3milion ㎡. In 2022, the LTPO TFT line and EDO’s 6th-generation rigid OLED line, which Samsung Display invested in to supplement the idle capacity of the A3 line, are scheduled to be operated. In 2023, LG Display’s E6-4 line and BOE’s B12-3 line Line, Samsung Display’s 8.5G IT line are expected to be put into operation in 2024.

As for the substrate area of small OLED for smart watch and smartphone, the line capacity for rigid OLED in 2022 is 5.29 million ㎡, accounting for 24.8% of the market share. Rigid OLED investment is not expected in the future. In 2022, the capacity for flexible OLED is 15.3 million ㎡, accounting for 71.5% of the total. From 2024, part of Samsung Display’s A3 line will be converted to an IT line, and the mass production capacity is expected to decrease. The line capacity for foldable OLED is expected to reach 0.79 million ㎡ in 2022 and 1.52 million ㎡ from 2023.

Samsung Display’s IT line capacity is expected to expand to 2.69 million ㎡ by 2025 as part of the A3 line is converted to an IT line in the first half of 2024. A new 8.5G line is expected to be operated in 2024. From the second half of 2023, LG Display’s capacity is expected to be 0.75 and 0.52 million ㎡, respectively, with the E6-4 line operating and BOE’s B12-3 line operating.

OLED line capacity for TV is not expected to change until 2026 unless additional investment is made. From 2022, LG Display’s mass production capacity is 20.3 million ㎡, accounting for 85.5% of the total. Capacity is expected to increase further depending on whether additional customers are secured in the future. Samsung Display’s capacity is 3.3 million ㎡ and BOE’s is 0.13 million ㎡, accounting for 13.9% and 0.6% of market share, respectively.

Meanwhile, the ‘2022 OLED Components and Materials Report’ published this time dealt with the latest OLED industry issues analysis, development of components and materials for foldable devices, industry status, analysis of mass production capacity of OLED panel companies, and major component and material market forecasts. It is expected to help parts and materials companies to understand related technologies and predict future technology directions and markets.

Can VR replace TVs and Monitors?

/in /by olednetVR devices have been on the rise since 2016 and were expected to be an important factor in IT business, but have not yet made a big impact. At CES 2016, Intel exhibited applications that enable creative activities such as education and art. In 2017, Samsung presented games and movies that can be felt with the body in 4D form at the IFA VR experiment zone.

VR features excellent immersion and presence. A 1-inch display can look like a 60-inch display. The display that provides information uses micro-display, but LCoS (liquid crystal on silicon) has a slow response speed, poor color, and low contrast ratio. So the trend is changing to OLEDoS (OLED on silicon). Sony is making its own micro OLED and Panasonic is working with US Kopin to make VR.

Recently, VR devices are preparing to replace monitors. If it is made in high resolution, about 10 screens can be displayed on each VR monitor screen. In the future, the monitor market will change to the VR market. VR can emerge as the best dark horse in the IT market. VR may possibly also replace TVs. A head speaker with a much better three-dimensional effect is essential. There may also be changes in the movie theaters as a VR device might provide a 60-inch screen and provide a high sense of immersion into the film for movie-goers.

Micro OLED composition consists of TFT designed on a silicon wafer and OLED is formed on it. LGD’s WOLED method is used for OLED. The RGB method requires a fine metal mask, but the AP system is preparing a mask capable of 2000ppi or more using a laser. Because WOLED uses a color filter, there is a loss of about 10%. RGB may be more advantageous in terms of luminance, but for commercialization, WOLED resolution can be much higher. Since it has been developed for a long time, WOLED is expected to be applied. Applications include military, medical, industrial, viewfinder, smart glasses, and the like.

Recently, Apple requested LG Display and Samsung Display to prepare Micro OLED. LG Display placed an order for the Sunic System evaporator in June and is moving quickly.

Samsung Electronics also has a request for VR. In 2025, it can be seen that LG Display and Samsung Display can produce many types of Micro OLED. We expect to see Apple’s VR devices around 2024.

Related Report : 2022 Micro-display REPORT

What is the future change of WRGB OLED to respond to QD-OLED?

/in /by olednet

2As Samsung Display’s QD-OLED begins to be applied to TVs and monitors in earnest in 2022, technological changes are being detected for LG Display’s WRGB OLED, which has been leading the large OLED market.

LG Display’s WRGB OLED has produced a WBC structure consisting of two blue layers and one red+yellow green layer in Paju by the end of 2021, and a WBE structure consisting of two blue layers and one red+green+yellow green layer in Guangzhou. Deuterium substitution technology was applied to the blue of the WBE structure.

Since 2022, LG Display has stopped producing WBC panels from its Paju line and has been producing ‘OLED.EX’ panels with deuterium substitution technology applied additionally to green of WBE produced in Guangzhou.

<Photo of OLED.EX presented by LG Display at the 2022 OLED Korea Conference>

At SID 2022, LG Display also exhibited a large OLED panel with micro lens array technology. Micro lens array technology was applied to Samsung Electronics’ ‘Galaxy S Ultra’ series, and it is the first technology applied to large OLEDs. LG Display is known to expect a 20% improvement in luminance compared to the previous one by applying micro lens array technology. Panels which micro lens array technology is applied are expected to be produced in Paju from the second half of this year.

Lastly, it is known that LG Display is developing a structure in which yellow green is removed from WRGB OLED. By eliminating yellow green, material and processing costs can be saved, and color gamut is expected to be improved.

Attention is paid to how LG Display’s WRGB OLED will evolve to compete against QD-OLED.

<OLED panel with micro lens array technology exhibited by LG Display at SID 2022>

Introducing iPhone 14 Display Specifications and Panel Vendors

/in Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display, Display /by olednet

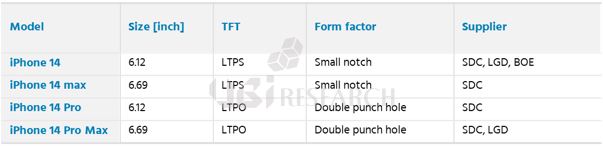

<Apple iPhone 14 Series Specifications>

Samsung Display, LG Display, and BOE are expected to supply panels to Apple’s new iPhone 14 series in 2022. It is expected that Samsung Display will supply panels to all models in addition to iPhone 13 series. LG Display will supply 6.12-inch LTPS models and 6.69-inch LTPO models. BOE will supply panels only to 6.12-inch LTPS models.

The existing 5.4-inch mini model has been removed from the iPhone 14 series and a 6.69-inch Max model has been added. The size and resolution of iPhone 14 Max are the same as iPhone 14 Pro Max and LTPS TFT is applied instead of LTPO TFT.

In terms of design, the iPhone14 Pro and 14 Pro Max will have a punch hole design instead of the conventional notch. Apple’s punch hole design is expected to be applied as a double punch hole design due to various sensors and cameras.

Meanwhile, the total OLED panel supply to Apple in 2022 is expected to be about 215 million units, with Samsung Display expected to supply 135 million units, LG Display 55 million units, and BOE 25 million units. However, shipments are expected to be organically controlled due to market conditions and Apple’s policies.

[2022 OLED KOREA CONFERENCE] LG Display’s OLED 3.0 Captures Brightness and Lifespan Simultaneously

/in /by olednetAt the keynote session of UBI Research’s ‘2022 OLED Korea Conference’ held from April 6th to 8th, Sang-Hyun Ahn, Managing Director of LG Display, announced, ‘The Present and Future of Automotive OLED Display: LG Display’s Future Outlook’.

Director Ahn announced, “The future will transform people and vehicles, and vehicles and vehicles to be connected, autonomous, shareable, and electrically driven. In order to respond to these changes, vehicle displays are getting bigger and more diverse in design, and displays are being applied to various locations to provide sights and information”.

Director Ahn continued, “The automotive display industry was led by LCD, but the OLED market is also gradually expanding its area.” He predicted, “The automotive OLED market will be worth $1.2 billion in 2025, It is also possible to grow to $6 billion.”

In addition, Director Ahn said, “LG Display has already introduced an OLED 1.0 structure that satisfies the minimum requirements for automotive display: brightness of 800 nits and lifespan of 10,000 hours. Unlike OLED for smartphones, OLED for automobiles requires brightness of 800 nits or more to grasp accurate information even during the day, and lifespan of 10,000 hours or more is essential because the use cycle is more than 10 years. Although there is a trade-off between brightness and lifetime, we plan to develop OLED 3.0 with a brightness of 1,000 nits or more and a lifetime of 10,000 hours or more by overcoming this through development of materials and structures.”

Lastly, Director Ahn mentioned about future displays such as extra-large and transparent, slidable, and rollable that are applied to vehicles and said, “Many companies want large and many screens, but they want to hide those screens inside the vehicle. Slidable panels, which can be a solution to this, are already technologically stable and can become common around 2025. On the other hand, rollable panels, such as those that come down from a vehicle sunroof, still have a long way to go, but we will continue to develop them.”

[2022 OLED KOREA CONFERENCE] LG Display Executive Vice President Hyun-Woo Lee, Advancements in the Display Market with Technological Innovation that Suits Changing Lifestyles

/in /by olednet

Executive Vice President Lee explained OLED technology innovation, future application fields, and market changes. He mentioned that COVID-19 has increased everyone’s time at home and changes in life display is necessary to match it.