OLED emitting material usage will grow 28% year-over-year in 2025

UBI Research’s “2025 OLED Emitting Materials Report” analyzes the latest trends and key issues in the OLED industry and comprehensively analyzes the technological development direction of OLED panel companies and luminescent materials companies. It also analyzes the mass production capacities of OLED panel companies, supply chain and panel structure, and analyzes the performance of luminescent materials in detail and forecasts the market size.

In terms of technology trends, the competition for high-efficiency and long-life luminescent technologies such as hyperfluorescence and phosphorescent materials is intensifying, and improving the external quantum efficiency and lifetime of blue materials is emerging as a key challenge for market expansion. While material innovations such as deuterium-substituted and boron-based fluorescent materials are actively underway, Chinese companies are rapidly expanding their presence in the dopant and host sectors, deepening their penetration into the global supply chain.

In 2024, the use of luminescent materials was 129 tons. This was up nearly 30% from 101 tons in 2023, driven by simultaneous increases in shipments from Korean and Chinese panel makers. Samsung Display continues to account for the largest share, and its rigid OLED shipments have been increasingly driving material usage.

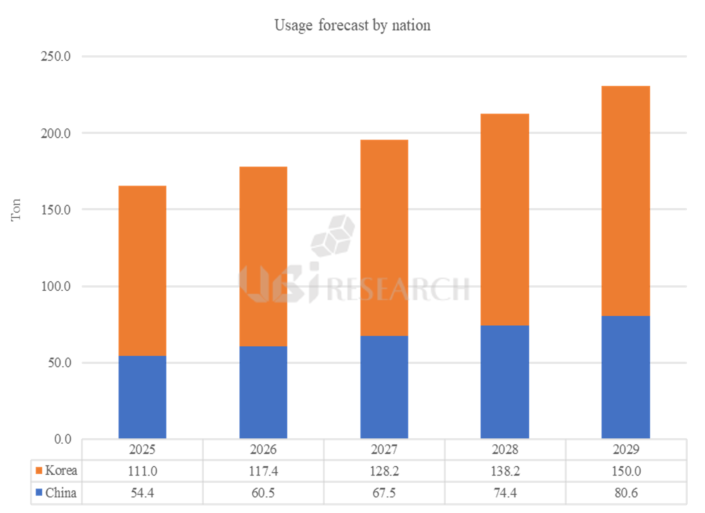

“OLED emitting material demand from Korean panel makers is expected to reach 111 tons in 2025 and 150 tons in 2029, while material demand from Chinese panel makers is expected to grow at a CAGR of 10.3% from 54.4 tons in 2025 to reach 80.6 tons in 2029,” said Changho Noh, a research director at UBI Research.

Chang Ho NOH, UBI Research Analyst(chnoh@ubiresearch.com)

2025 OLED Emitting Materials Report Sample

2025 OLED Emitting Materials Report Sample