With SID 2025, Samsung Display proved to be a pioneer in OLEDs.

Samsung Display proved itself as an OLED pioneer at SID 2025. Samsung Display presented the world’s best technology in three themes: the best technology possessed by OLED pioneer companies, and a three-dimensional exhibit that allowed visitors to experience in advance what tomorrow’s OLEDs will look like.

The ‘OLED Frontier’.

The world’s first QED 18.2-inch display applying environmentally friendly Cd-free field emission quantum dot (EL-QD) technology, EL-QD is a new technology that applies an electric field directly to quantum dots to emit inorganic light, realizing accurate color representation and accurate color representation of QD. It achieves BT2020 86% color reproduction and 400 nits performance without color filters. Samsung Display will further improve the performance and aims to launch the product within two years. The 27-inch QD-OLED monitor presented together will experience the world’s largest resolution of 220ppi with 5,120 x 2,880 pixels. With organic light diode bilo sensors built into every pixel in the display area, the Sensor OLED display can measure physical indicators such as heart rate, blood pressure, stress, and atrial fibrillation with a finger.The Sensor OLED display, which was named SID Outstanding Paper of the Year, was also featured in ” Nature Communications” and was also featured in the Nature Communications.

‘From Pixel to Perfection’.

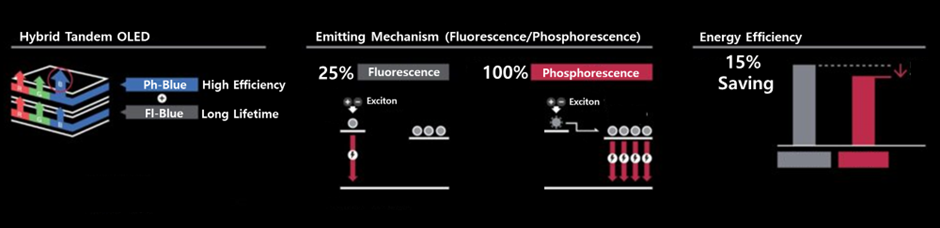

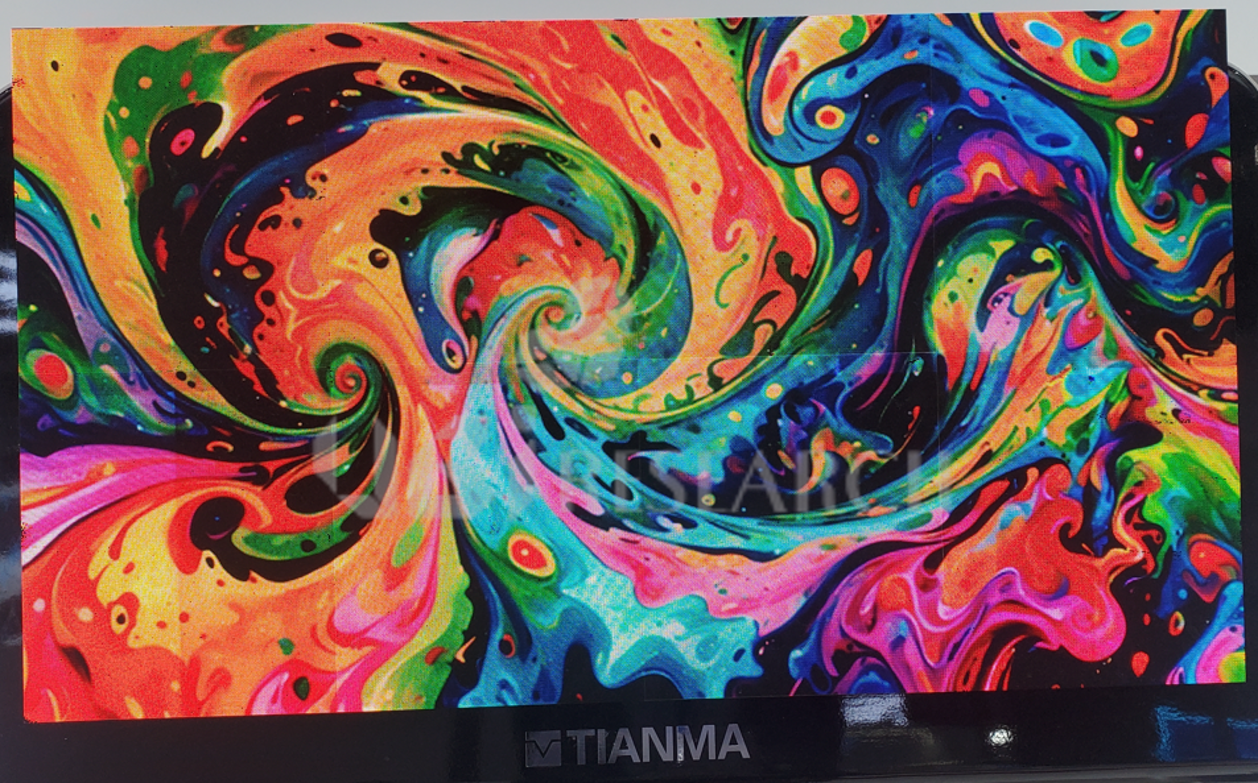

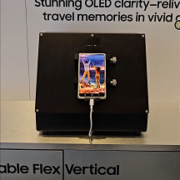

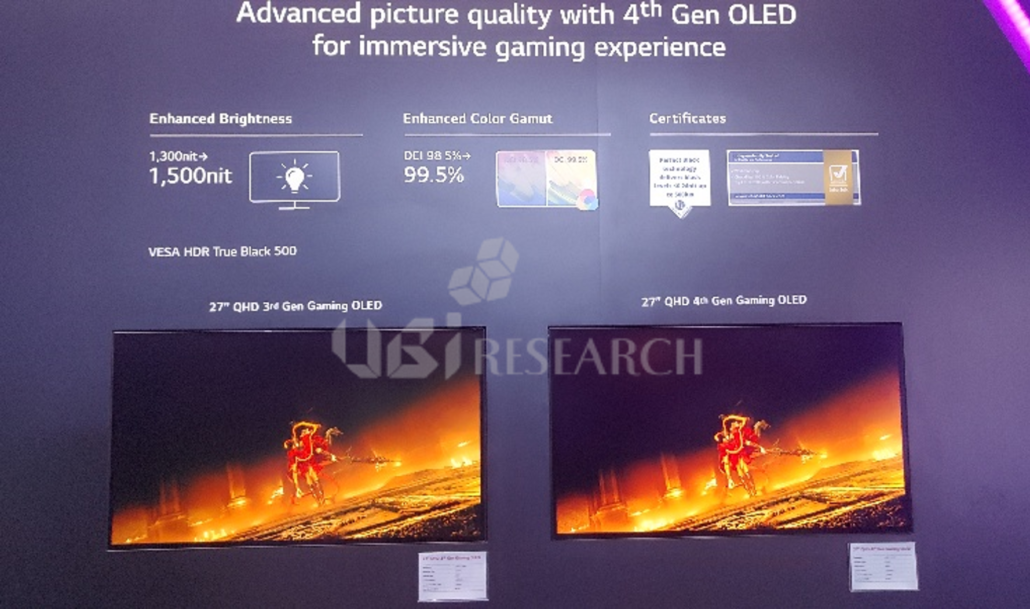

With the introduction of new EL materials with improved blue organic materials, the 65″ UHD TV in 2025 achieves 4,000 nits of brightness, a 33% improvement over the previous model and the world’s highest brightness. The company also introduced the world’s first 27″ OLED gaming monitor with 500Hz drive technology. 6.8″ Bezel-less smartphone display with up to 0.6mm thin bezel creates an unrealistic illusion. 6.8″ OLED on top of a 14.6″ OLED panel The panels were displayed in such a way that they appeared to be a single panel, as their boundaries were not visible. LEAD technology, introduced for the first time in the world, is an OLED panel technology that has the same reflectivity and bright room contrast as before, even when the polarizer on the OLED surface is removed. LEAD technology is originally characterized by low power consumption, thinness and lightness.

‘Designing Tomorrow’

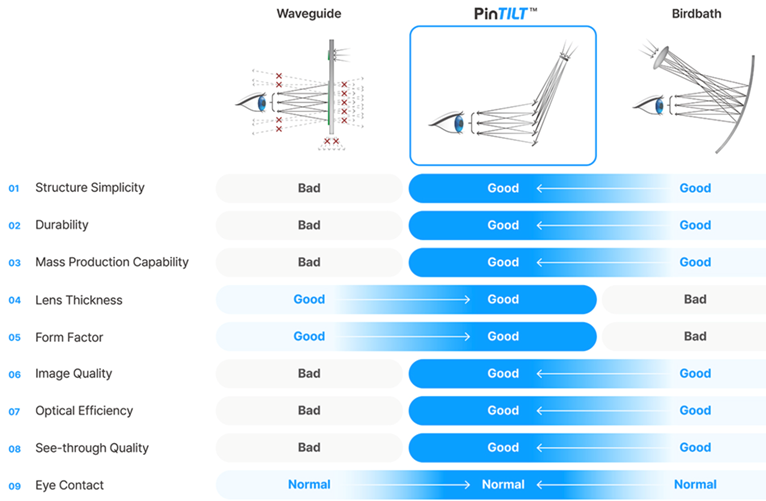

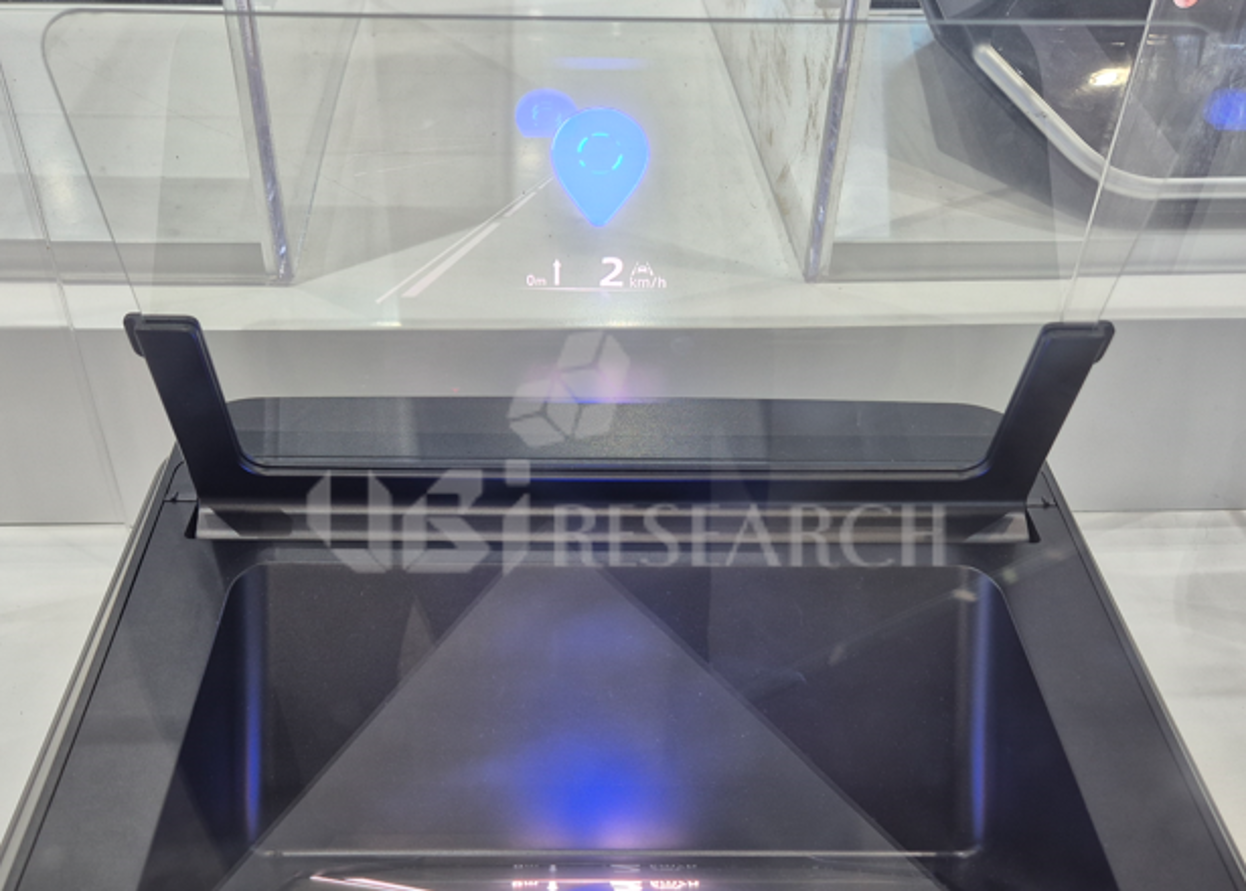

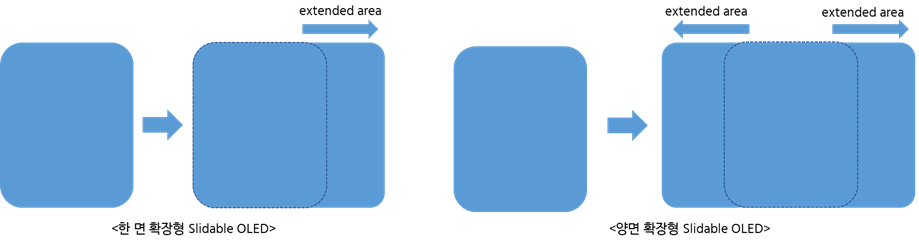

Future next-generation displays were also unveiled through Samsung Display, introducing unique form factors such as rollable and foldable displays. Stretchable displays with increased displacement from last year were also exhibited. RGB OLEDoS with up to 5,000ppi were shown as a solution for ‘new realities’.

Mr. Lee Chang-hee, Director (Vice President) of the Display Research Institute, expressed his pride in being able to showcase Samsung Display’s unparalleled technological capabilities and emphasized the company’s commitment to further pioneering the development of new technologies.

Joohan Kim, UBI Research Analyst(joohanus@ubiresearch.com)

2025 Small OLED Display Annual Report Sample

2025 Small OLED Display Annual Report Sample

China Trend Report Inquiry

China Trend Report Inquiry