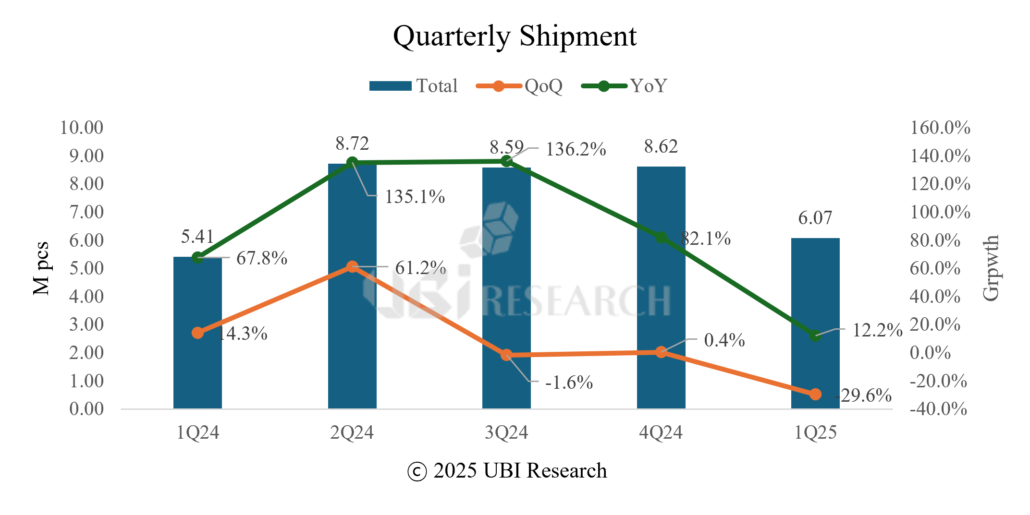

OLED shipments for medium-to-large panels in Q1 2025 increased by 12.2% year-over-year, driven by growth in tablet PCs, monitors, automotive displays, and TVs.

2Q25 Medium-to-Large OLED Display Market Track

According to UBI Research’s “2Q25 Medium-to-Large OLED Display Market Track,” OLED panel shipments for medium-to-large displays in Q1 2025 increased by 12.2% year-over-year, while revenue grew by 17.1%.

By manufacturer, Samsung Display and LG Display saw year-over-year growth in their medium-to-large OLED shipments, whereas Chinese panel makers maintained a similar performance compared to Q1 2024.

By application, shipments increased across tablet PCs, monitors, automotive displays, and TVs, while notebook panel shipments experienced a slight decline. Notably, shipments for automotive OLED panels tripled, growing from 270,000 units in Q1 2024 to 810,000 units in Q1 2025. Samsung Display’s automotive OLED shipments surged from 100,000 to 540,000 units, while LG Display, BOE, and Everdisplay maintained levels similar to the previous year.

In addition to BOE and Everdisplay, Tianma has recently been actively promoting its automotive OLED panels and expanding its customer base. The 2025 shipment forecast for automotive OLED panels stands at 3 million units, reflecting a 20% increase from 2024.

For tablet PCs, OLED shipments in Q1 reached 1.95 million units, a decrease of 250,000 units from 2.2 million units in the previous quarter. While both Samsung Display and Chinese panel makers experienced slight quarter-over-quarter declines, LG Display more than doubled its shipments compared to Q4 (300,000 units), thanks to the resumption of panel production for the iPad Pro.

“Chang Wook Han, Executive Vice President at UBI Research, stated that the growing demand for high-end automotive displays, combined with the increasing adoption of OLED by premium brands, is expected to drive continued growth in the automotive OLED market.”

Chang Wook HAN, Executive Vice President/Analyst at UBI Research (cwhan@ubiresearch.com)

Quarterly Medium & Large OLED Display Market Track Sample

Quarterly Medium & Large OLED Display Market Track Sample