DNP Secures Exclusive Deal with BOE for 8.6G OLED FMM Supply, Strengthens Market Leadership Amid China’s Push for Localization

(Source: DNP)

Japan’s Dai Nippon Printing (DNP) is reaffirming its dominance in the Fine Metal Mask (FMM) market, a key component in OLED manufacturing. Recently, DNP signed an exclusive supply agreement with China’s leading display company BOE for FMMs used in 8.6-generation OLED panels, signaling a proactive move into the expanding large-size OLED market.

This agreement is part of BOE’s strategy to begin mass production on its new 8.6-generation OLED lines. To support this, DNP has established a new FMM production line at its Kurosaki plant in Fukuoka, Japan. The facility is equipped to handle substrates over twice the size of those used in 6th-generation lines and is optimized for high-resolution, large-size OLED panel deposition processes. The new line has also been designed with flexibility in mind, capable of producing some 6th-generation products as needed.

Currently, DNP holds exclusive supply agreements with major Chinese panel makers—including BOE (excluding its 5.5-generation lines), CSOT, and Tianma—for 6th-generation lines, maintaining a 100% market share in that segment. However, some panel manufacturers have started trialing domestically produced FMMs, although the extent of their use has not been statistically verified. Despite ongoing efforts to localize FMM production in China, achieving the same level of precision and yield as DNP remains a significant challenge.

To ensure stable supply and expand production capacity, DNP is operating both its existing Mihara plant in Hiroshima and the new facility in Fukuoka. This dual-site strategy not only enhances production scalability but also improves customer trust by serving as a Business Continuity Plan (BCP) safeguard against natural disasters like earthquakes.

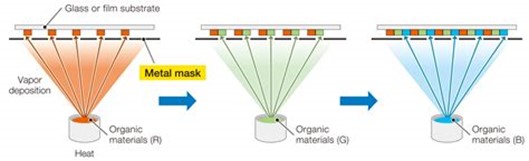

FMMs are critical materials used in the OLED deposition process to accurately pattern RGB subpixels, directly affecting panel resolution and production yield. Samsung Display also sources ultra-thin 25μm FMMs from DNP while pursuing diversification strategies through collaborations with Korean companies. Domestic suppliers such as Poongwon Precision are accelerating their FMM mass production efforts to challenge DNP’s market dominance.

By securing this major deal with BOE, DNP has solidified its position as a key partner in the transition to next-generation OLED mass production and once again demonstrated its strategic edge in the increasingly high-generation global OLED market.

Junho Kim,Analyst at UBI Research (alertriot@ubiresearch.com)

China Trend Report Inquiry

China Trend Report Inquiry