Small OLED display shipments in 2024 are expected to increase by 200 million units compared to 2023 and exceed 1 billion units in 2025

‘1Q25 Small OLED Display Market Track’

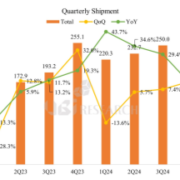

According to UBI Research’s ‘1Q25 Small OLED Display Market Track’, which includes application performance and outlook for smartphones, foldable phones, smartwatches, etc., small OLED shipments in 2024 are expected to reach 980 million units, an increase of approximately 200 million units from 773 million units in 2023. The small OLED market is expected to exceed 1 billion units in 2025.

Looking at the 2024 performance, most panel manufacturers in Korea and China saw an increase in shipments of 40 to 50 million units, and in particular, Chinese panel manufacturers TCL CSOT, Tianma, Visionox, and Everdisplay saw shipments increase by more than 50% compared to 2023. BOE, China’s largest panel manufacturer, saw its panel shipments increase by only about 8% due to temporary production suspensions caused by disruptions in iPhone supplies throughout the year.

Not only Chinese panel makers, but also Korean panel makers have seen a significant increase in shipments. As rigid OLED panels began to be applied to Samsung Electronics’ Galaxy A series, Samsung Display’s shipments are expected to surge from 320 million units in 2023 to 380 million units in 2024. LG Display’s smartphone OLED shipments also increased from 52 million units in 2023 to 68 million units in 2024 as its supply of panels for iPhones expanded.

With Chinese panel makers’ shipments steadily increasing, and Samsung Display’s rigid OLED shipments and LG Display’s iPhone panel shipments also increasing, small OLED shipments in 2025 are expected to easily exceed 1 billion units.

“OLEDs are being widely applied to lower-end models of Samsung Electronics’ Galaxy A series and low-cost models from Chinese set manufacturers, and BOE and Visionox’s new 8.6G lines are also designed to produce panels for smartphones, so small-sized OLED shipments are expected to continue to rise for the time being,” said Han Chang-wook, Vice President of UBI Research.

Chang Wook HAN, VP/Analyst, UBI Research(cwhan@ubiresearch.com)

Small OLED Display Quarterly Market Track Sample

Small OLED Display Quarterly Market Track Sample